We’re sharing the first externally audited Lendermarket Limited Annual Report and Financial Statements for the financial period from June 2019 until December 2020.

In this document, audited by Grant Thornton, investors and stakeholders can find the Director’s Report, the Independent Auditor’s Report, and all relevant information concerning the Financial Statements.

Link to the Audited Annual Report

Results at the end of 2020

During the first year and a half of operations, through 2019 and 2020, Lendermarket has been creating a solid foundation in which to develop the platform. Among other activities, this involved hiring our first team members and gathering valuable feedback from investors.

The calendar year 2020 highlighted a strong interest in our offerings from both loan originators and investors, which resulted in significant business growth throughout the year.

- From the investors’ side, by the close of last year, 4,021 new users joined Lendermarket and held investments of €10.4 million on the platform. In addition to these figures, we are also proud to announce that Lendermarket has reached investors from all EU countries and all continents.

- From the loan originators’ side, in 2020, our monthly revenue grew 279%. During the first year and a half of operations -audited financial period-, Lendermarket generated €167,000 in revenue from service fees charged to loan originators.

During the reporting period, Lendermarket made considerable investments in platform development, customer acquisition, and team expansion, resulting in a planned net loss for the period. This loss has been covered by shareholders’ capital.

Current Year and Future Developments

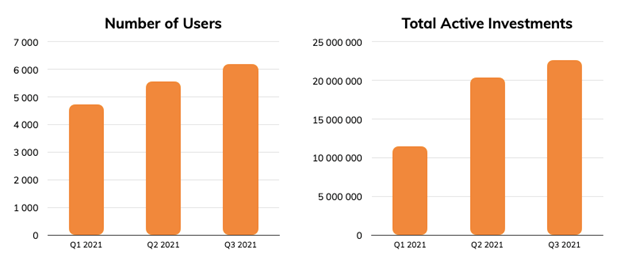

This year, we saw a significant user confidence increase on the platform, where the average investment account has grown by 30% this year to reach an average total of €6,830. Also, at the end of June 2021, we celebrated that total active investments on the platform had surpassed €20 million.

With all of this in mind, we are ending 2021 with great ambition, intending to continuously invest in the development of our platform. Lendermarket expects to connect with new loan originators from additional locations, as well as to offer new and innovative loan products on the platform. For these reasons, we anticipate that investors will receive the opportunity to take one step further when diversifying their investment portfolios.

We look forward to successfully and effectively completing another full year of operations.

6 responses to “Lendermarket Limited Audited Annual Report 2020 – Published”