Lendermarket is regulated by the Central Bank of Ireland and is duly authorised as a Crowdfunding Service Provider under Regulation (EU) 2020/1503 to provide investment services across the EU.

The Buyback Guarantee protects your investment—if a loan is overdue by 60 days, the loan originator repays your principal plus accrued interest. Learn more

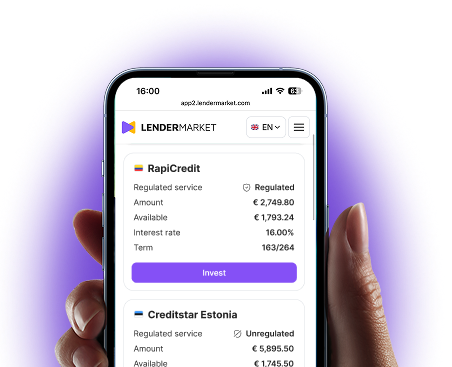

Rapicredit is the largest microlending fintech in Colombia, they provide consumer loans to individuals who don’t have access to traditional banking. Focusing on financial inclusion, they’re helping millions transition from informal loans to more secure options.

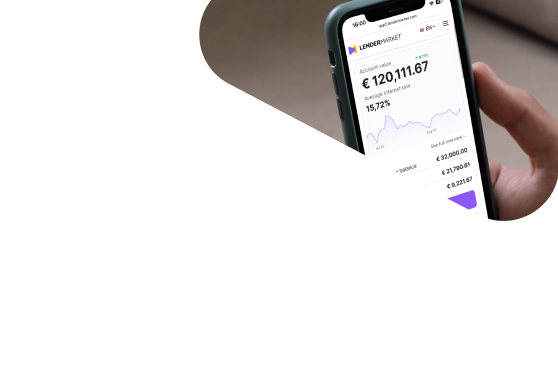

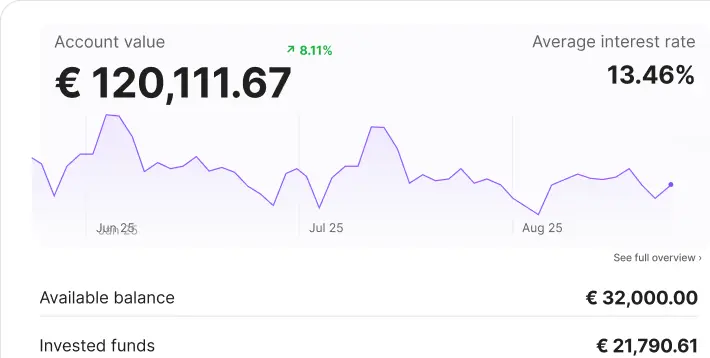

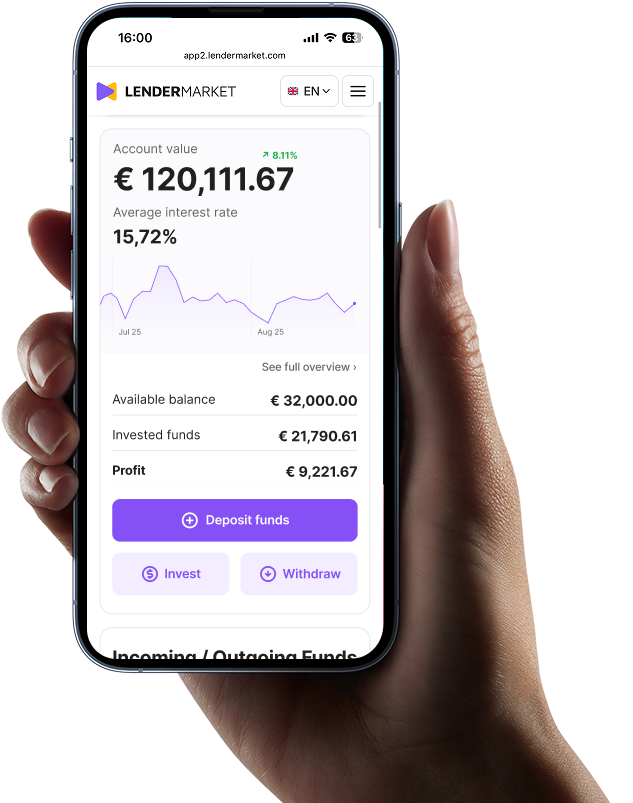

Average interest rate

18%

Skin in the game

10%

CrediFiel offers innovative financial solutions to underserved sectors in México, aiming to improve the quality of life for its clients through ethical high-quality services.

Average interest rate

12%

Skin in the game

10%

Dineo offers offline and online financial solutions for individuals seeking consumer loans in Spain. With a network of 75 locations they focus on helping non-digital users while maintaining a strong financial performance.

Average interest rate

12%

Skin in the game

5-10%

Creditstar Group, a leading provider of consumer financial services in Europe, offers unsecured online consumer loans with flexible repayment terms and a commitment to responsible lending practices.

Average interest rate

14%

Skin in the game

5%

“I never lost any money on the platform — not once in almost six years. The buyback guarantee works very well.”

“Lendermarket offers the most attractive interest rates I’ve seen, much better than other platforms I tried.”

“Once I got Auto Invest running, I had no reason to look for another P2P platform.”

Sep 2, 2025

Reliable platform offering great yields from a solid group like Creditstar. Smooth operation and predictability.

I’ve been with Lendermarket for more than 6 years now and I can say it works as advertised. My advice for new investors thinking about investing in Lendermarket is to think about it as a mid- to long-… See more

I have 2 accounts here one personal and one business until now i am totally happy with them.

*It is not a guarantee of returns. Investment in crowdfunding projects entails risks, including the risk of partial or entire loss of the capital invested. Additionally, you may not receive any return on your investment. Your investment is not covered by the Deposit Guarantee Scheme.

*It is not a guarantee of returns. Investment in crowdfunding projects entails risks, including the risk of partial or entire loss of the capital invested. Additionally, you may not receive any return on your investment. Your investment is not covered by the Deposit Guarantee Scheme.

Your bonus is waiting: Refer and Earn