Interest rates on Lendermarket have always been competitive and over the last 12 months showed a solid upward trend. Due to macroeconomic uncertainty in the financial markets over the last year, lending companies experienced a supply of funding shortage. They in turn came to platforms such as Lendermarket to raise capital. This led them to offer higher than average interest rates, regardless of the loan duration.

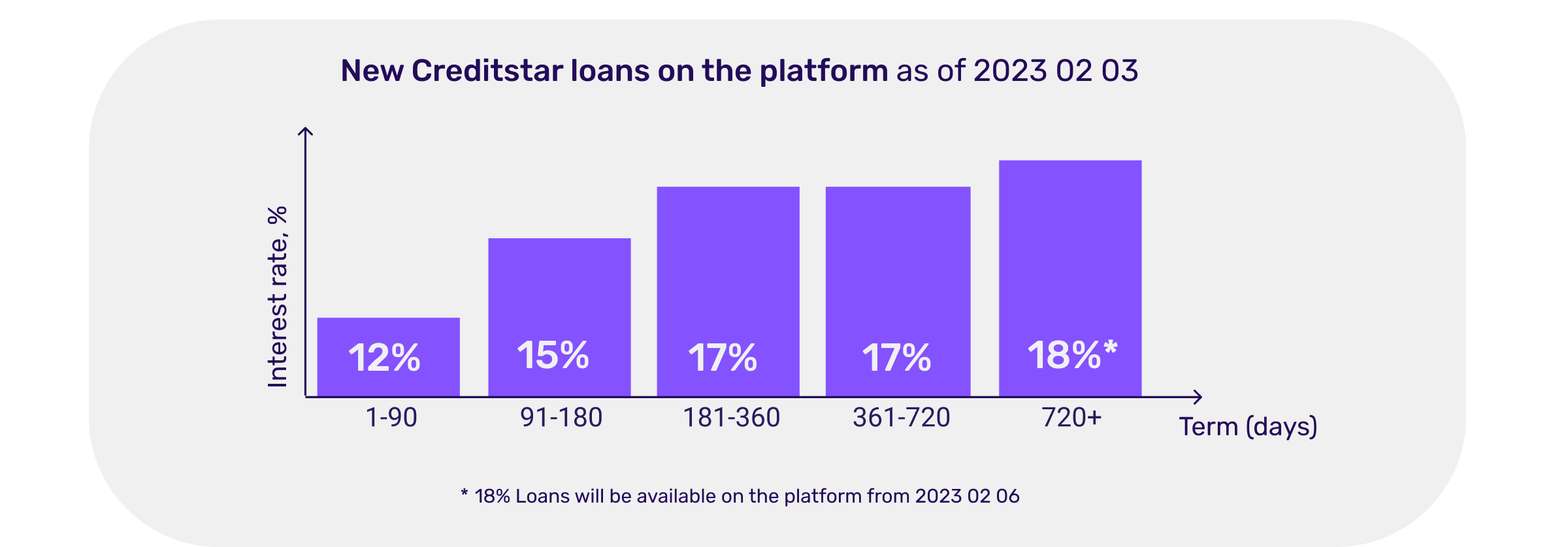

Currently, the demand is surpassing the supply of investment products on the platform. In order to make our products more sustainable, interest rates for loans on Lendermarket will be adjusted to increase with loan duration. With particular reference to new Creditstar loans on the platform, the interest rates will be adjusted accordingly:

We are confident that the shift from short-term to longer-term loans will bring further stability, not only to our platform but to our investors and our Loan Originators as well. Despite the fact that shorter term loans are typically less risky than longer term loans, margin levels for both short and long-term loans stayed relatively on par on our platform. This resulted in an unsustainable risk-reward profile of investments. By increasing interest rates on longer-term loans, balance will be restored for investment products on the platform.

Please note that interest rates for short term loans will be unaffected to Loan Originators based in markets where the risks are higher. The majority of changes are applicable to Creditstar Group’s offering.