If you want to start investing with Lendermarket, there are a few key things you can do to better achieve what you’re looking for: Whether that’s to maximize returns or achieve good returns while limiting the risk you’re exposed to. In this article, we’ll share the best practices to start investing with Lendermarket, so you can start your investment journey off right! After this, you’ll know what to do and which pitfalls to avoid.

Think long-term

One of the biggest issues many investors, not just on Lendermarket, have is that they view their investment portfolio as a way to achieve short-term gains. This offers a few drawbacks: For the one part, many markets are volatile and while in the short-term no one can predict what will happen, history shows that over a long-term markets usually go up.

This doesn’t apply as much to less volatile markets like P2P lending. However, the second principle still applies, which is that with a short investment horizon the rule of compound interest doesn’t become as fertile as it could be.

There’s also another mindset trick at work here: By thinking long-term and putting your investment money aside, you can focus on the present and are more encouraged to find ways to increase your income in the present. As opposed to banking on becoming rich in the very near future through your investment (a hope, which may not come true).

Long-term strategy to maximize results

We just mentioned compound interest, we have an in-depth blog article on the topic, but here’s how it works in a nutshell:

- If you invest 1000 EUR at 15% annual interest, you earn 150 EUR the first year.

- Leaving the 150 EUR in your account brings the amount you earn interest on up to 1150 EUR.

- Next year you will gain 172,5 EUR interest (1150 EUR * 15%), and the principal rises to 1322,50 EUR.

- The longer you stay invested, the bigger your principal and the interest payments become.

- After 20 years you would end up with a total of 16,366.54 EUR invested, after 30 years 66,211.77 EUR.

In comparison: Taking out the interest every year would leave you with 4500 EUR in interest + 1000 EUR principal after 30 years, a total of 5500 EUR. 60,500 EUR less than with compound interest!

The higher the expected yearly return rate, the bigger the disparity between compound interest and simple interest will become.

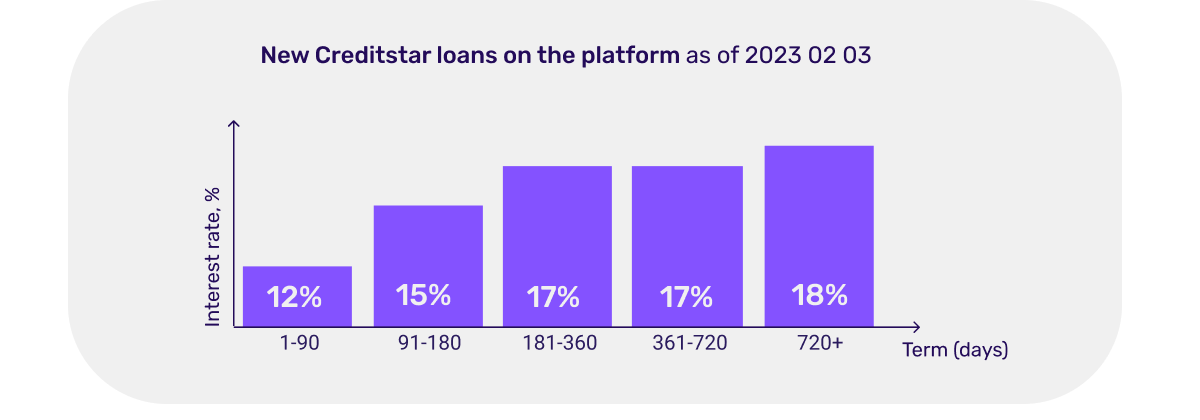

Moreover, with Lendermarket, the long-term loans offer, in general, a higher interest than short-term loans. With particular reference to new Creditstar loans on the platform (as of 2023 02 03), the interest rates are presented below:

Understanding Returns

Understanding your returns is key to making effective investments. The main factors to keep in mind here are:

- The principal invested

- The interest rate

- The timeframe you stay invested

With these three variables you can then calculate your total interest, by using the following formula: Interest = (Principal x Interest Rate) / 360 x Term.

This means that in general you will achieve higher returns if:

- You invest more money

- Your investment offers a higher interest rate

- You stay invested for longer

The following table illustrates the effectiveness of increasing your investment’s principal and investing longer-term:

| Principal | Interest Rate | Term (Days) | Returns |

| 10 EUR | 15% | 2 | 0.0083 EUR |

| 20 EUR | 15% | 30 | 0.25 EUR |

| 100 EUR | 15% | 180 | 7.5 EUR |

As you can see, if you only stay invested for a short timeframe, then the interest will be miniscule as well. Investing money takes time, and if you can let your money work for you longer, the investment will in many cases yield bigger fruits.

Do short-term loans increase liquidity?

Liquidity is an important factor to consider in your investment because it shows you how easily you could convert your investment to money at its given value. An example of a very liquid market is the stock market, whereas a very illiquid market is the real estate market.

P2P loans have a unique set of circumstances that can affect liquidity because repayments might be late and due dates can change depending on the Loan Originator’s extension policy.

To ensure your expectations about liquidity align with your investment decisions, carefully read our FAQ on What is a Buyback Guarantee, and how does it work? as well as Loan Originators’ extension policies on the linked page under the heading “learn more”.

The table below illustrates a “worst case” scenario of how late repayments and extensions can impact liquidity. In this example, the loan uses the maximum amount of extensions and late days possible before the Loan Originator’s Buyback Guarantee kicks in.

| Original Due Date | 6 Extensions | + 60 Late Days | Buyback Date |

| 01/01/2022 | + 180 Days | 30/6/2022 | 29/8/2022 |

In 2022, very short-term loans (90 days or less) had the highest incidences of late days compared to longer-term loans.

Please note that on Lendermarket, you will still earn interest for loans that have their due date extended or even enter a default status.

Long-term strategy to manage risk

As initially mentioned, a long-term strategy allows you to “ride out” any temporary negative changes in the market, which will in turn save you from making shortsighted decisions and ultimately selling at a loss. Here’s how Lendermarket can help you when you’re looking to adjust the risk of your investment.

Set up a custom auto invest strategy

With Lendermarket’s auto invest feature, you can define the parameters by which the AI will invest your money. Over 6300 of our investors already use this feature. Auto Invest includes:

- The minimum and maximum amount of the portfolio

- How much is invested into each single loan

- The interest rates

- Origin of loan originators

- Loan originators to invest in

- Much more

This way you can tailor the portfolio to your specific needs. Using the Auto Invest feature is free of charge on Lendermarket and you can find more information about it in our FAQ section.

Create a diversified Lendermarket portfolio

You can make the most out of Lendermarket’s Auto Invest feature, by creating multiple AI portfolios with different settings. Doing this you can diversify your portfolio, as you can set certain portfolio sizes for each loan originator, consumer loans and real estate backed loans, loans from certain countries and with certain interest rates.

Having loans from multiple loan originators, different countries and with different loan types will boost the diversification of your portfolio. Check the best practices of diversification in investments here.

Bottom line

You now know the best practices to investing with Lendermarket:

- Think long-term

- Understand how interest is calculated

- Consider liquidity

- Diversify for better risk management

We hope that this article provides you everything you need to start investing on Lendermarket successfully!

Please note that, as all information provided on Lendermarket, this guide should not be construed as professional or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or content on Lendermarket before making any decisions based on such information or content. Lendermarket cannot be held liable for any losses which may result from basing investment decisions on information provided on this website.