Being able to automatically invest into P2P loans without picking all of them manually is a godsend. That’s what the Auto Invest feature is here to help you with. In the first part of this two-part series we showed you how to set up the tool initially, and in this second part you’ll learn how to make the most out of it. Let’s get started!

Small recap of the first article

The first article on Auto Invest revolved around making sure you got the basics right. The following features were part of that article:

- Portfolio name

- Minimum and maximum investment amounts

- Include loans you already invested in

- Loan originators

By getting these settings right, you set the foundation to receive good results with the AI. For example, you can give portfolios descriptive names, so you instantly know what they’re about, adjust the min and max investment amounts to achieve your desired diversification and double down on diversification by enabling or disabling investing into loans already invested in.

However, that’s not all there is to the Auto Invest feature, and you have a couple more settings available to make each portfolio fit your requirements.

How to make the most out of your Auto Invest

In this article, we want to cover the remaining four things to customize in your AI portfolio:

- The portfolio size

- An option to toggle reinvesting

- Interest rate

- Remaining term

These can greatly influence how your portfolio performs, so let’s see how to make the most out of it.

Portfolio size

The name of this setting is basically self-explanatory. When setting the portfolio size, you can let the Auto Invest know how much of your funds should go into this particular portfolio. Once that limit is reached, the AI will stop investing funds for this portfolio.

However, this only applies when you toggle “Reinvesting” off, more on that in a bit. Therefore, we suggest keeping the portfolio size high or increase it periodically to not run into the problem of having uninvested funds in your account.

Of course, you can also decide to set the portfolio size at a smaller limit. This can be useful if you want to build a handful of different portfolios with varying criteria. Nevertheless, if your “Reinvesting” feature is turned off, it is a good idea to check your account regularly to see if there are any uninvested funds.

If you want to find out the size of a specific AI portfolio, you can go to “My Investments” in your Lendermarket dashboard. If the loan shows a yellow “AI”, then it has been invested via Auto Invest and by hovering over it you can find out which portfolio the loan is in. Adding up all numbers under “My investment” gets you the total invested amount in this portfolio.

Option to reinvest

When creating an Auto Invest portfolio, you can choose to toggle the option “Reinvesting” on or off. If it’s off, then the interest you receive from loans will not be invested back into new loans, and also the portfolio size you set will become a hard limit. This means that if the portfolio is full (reached its maximum portfolio size) no more money will be invested into it.

If you toggle Reinvesting on, then the portfolio size becomes a soft limit. That means that if your max portfolio size is reached, the AI won’t invest more money from new deposits, however will still invest money you receive back as interest from existing investments.

An example:

Let’s say you have a portfolio with the Reinvesting feature turned on. Your portfolio size is 10,000 EUR and your investment through this AI portfolio is also 10,000 EUR (which means the AI limit is reached).

Under these conditions, if you deposit 100 EUR to your account, this money will not be invested through this AI portfolio since your limit is full.

But if you receive a 100 EUR repayment from one of the loans, then this 100 EUR will be reinvested, although the limit is full. It works like this because the 100 EUR repayment is not considered a new investment by the AI portfolio but a reinvestment.

Whether to turn on reinvesting depends on your plans and if you want to harness the power of compound interest or not.

Interest rates and remaining terms

Probably one of the most exciting settings to make in your AI portfolio is defining the interest rates and remaining terms. Both are pretty self-explanatory:

- “Interest Rate” lets you set a range of interest rates the AI should consider when investing your funds

- “Remaining term” allows you to specify the remaining duration until the end date of the loan is reached

There are some points to keep in mind when setting either of these values:

- Interest rates are the annual rates which are also displayed in the loan listings page. If you put some unrealistic rates here, your AI wouldn’t find any loans that match these rates and your funds may remain uninvested.

- Remaining terms are not the total terms of the loan. You can see the remaining and total terms together in the loan listings page and adjust your AI terms accordingly.

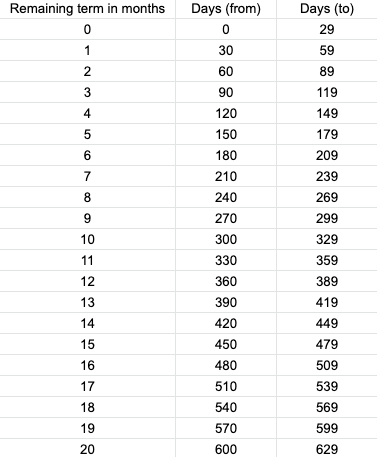

- The remaining term filter works on a monthly basis, where one month has 30 days. Here’s an example of how many days are left in the loan, depending on what number you set. The maximum value here is 85 months.

Conclusion

The Auto Invest feature allows you to created detailed portfolios with a number of different specifications. It is a simple to use, yet powerful tool to help you achieve your desired investment goals.

Play around with the different settings to see how they work, and then think about what you want to achieve with your portfolio? Are you looking for medium or high returns? Do you mind how long the remaining term of the loan is? Intend to reinvest the interest or use it for your expenses? All these questions can help you define your ideal AI portfolio.