We use cookies to enhance your website experience. By using this website, you agree to our use of cookies.

We are updating the rules of the platform, effective 1st February 2026, to outline platform fees for certain deposit and withdrawal transactions on Lendermarket, while maintaining fee-free options for investors. This update supports sustainable platform growth and ensures continued access to features like card deposits and withdrawals, while keeping Lendermarket accessible. Learn more.

As part of our compliance with the European Crowdfunding Service Providers Regulation (ECSPR), all investors are required to complete an investor questionnaire. This process helps us assess your investor profile, display the correct risk warnings and disclosures, and support you in evaluating investment opportunities appropriately.

Investors can now cancel a pending withdrawal request directly via the transactions page — no need to contact the Support team. Simply navigate to the page and make the desired changes. This feature empowers investors to manage their withdrawals independently, saving time and eliminating the need to wait for assistance from the Support team.

You can now view and monitor all your transactions — including deposits and withdrawals — in one central place via the new Transactions page. This update is designed to simplify transaction tracking and support more efficient data analysis for Lendermarket investors.

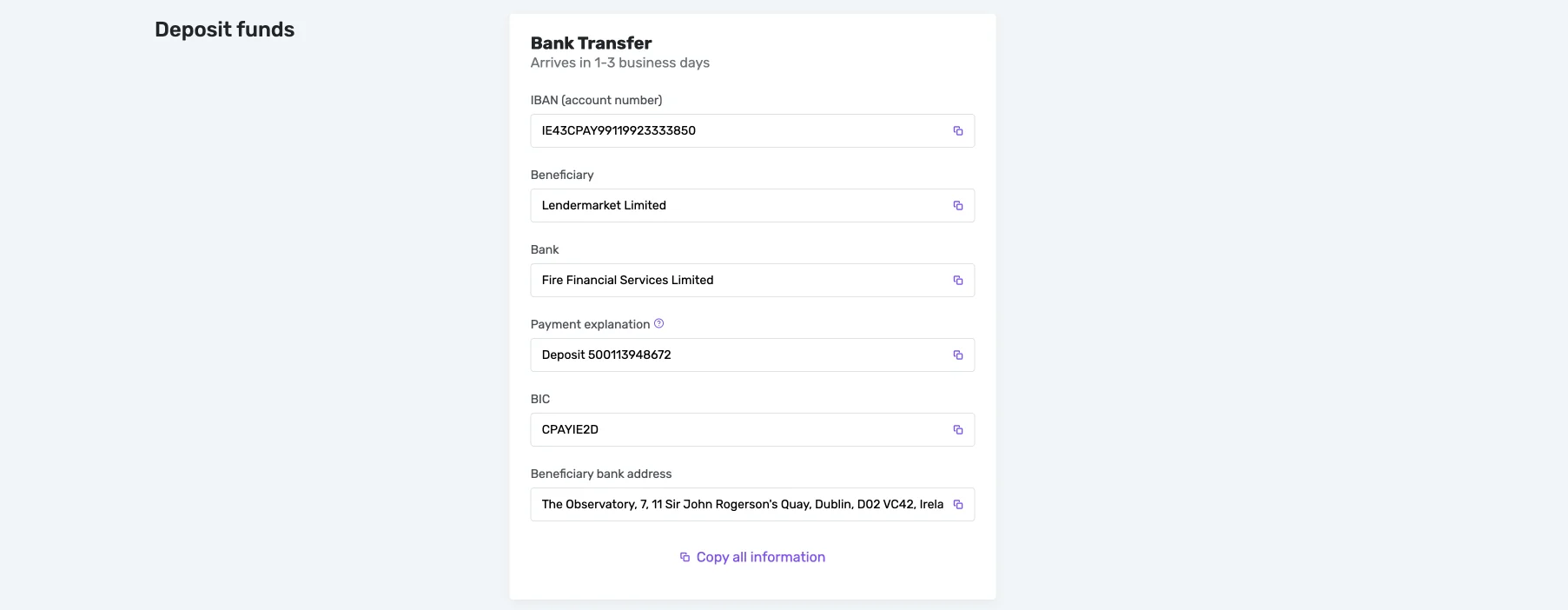

You can now top up your Lendermarket account using your Mastercard or Visa. This upgrade offers greater flexibility for investors, enabling instant access to deposited funds through a faster and more seamless process.

The referral bonus is now calculated over a 90-day period, rather than the previous 30 days. Both you and your referred friend will receive 1% of the Average Daily Invested Funds your friend invests within 90 days from the Date of Validation. This enhancement has been introduced as an added incentive for the Lendermarket investor community. Terms and Conditions apply.

Investors can now save their referral links to Apple Wallet Pass and share their personal referral QR code. This update makes it even easier for Lendermarket users to benefit from the referral programme.

Lendermarket is now accessible in an additional language. Investors from Poland can select Polish as their preferred language in the settings, allowing them to use the platform and receive emails in their native language. This update enhances the experience for our growing user base in the region.

You can now speak directly with a support representative via our new Live Chat feature, available on the homepage during office hours (Monday to Friday). Additionally, our in-app Knowledge Base provides quick answers to frequently asked questions. This update significantly improves the support experience, offering faster and more convenient assistance to all users.

Every new investor who joins Lendermarket now receives a €10 welcome bonus. Once an investor creates an account, the bonus is automatically added to their portfolio and invested using the Auto Invest tool. This incentive was introduced as an added value for Lendermarket investors.

The Risk Rating calculation logic and the Loan Originators’ risk rating are updated on the Lendermarket platform. The risk ratings have been updated to provide the community with relevant information, enabling them to make more informed investment decisions. Learn more.

The Lendermarket community now receives daily summary emails with quick access to investment information, making it easier to track portfolios and stay informed. Daily Summary emails are designed to enhance investment monitoring and improve the user experience.

Investors can now edit their phone numbers and toggle notifications on or off based on their preferences within the settings. This improvement enhances personalization without requiring investors to contact Lendermarket support.

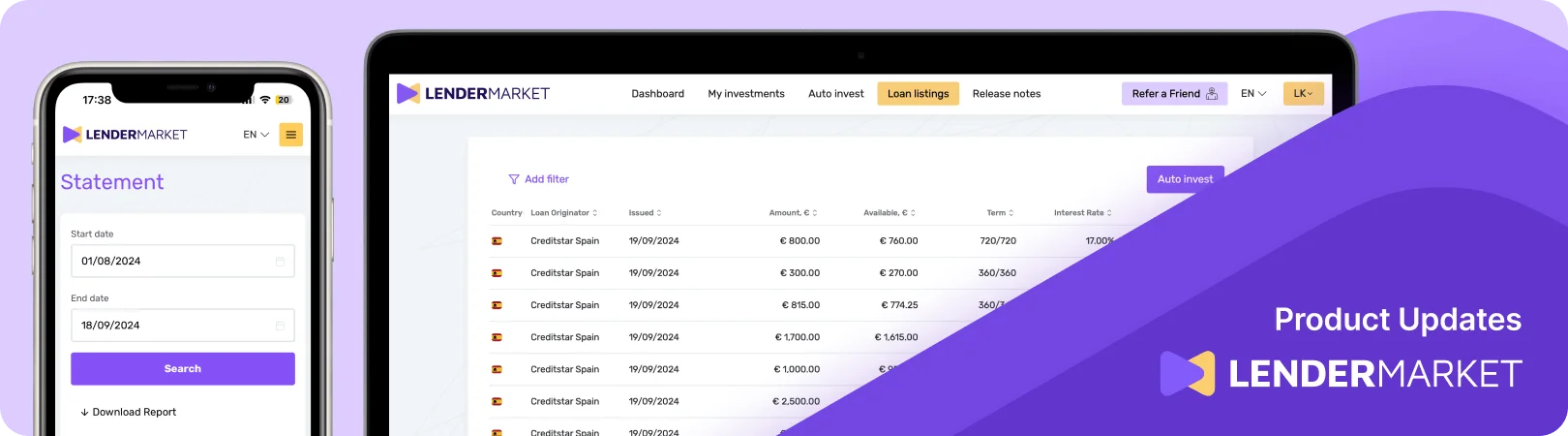

The Loan Listings and Statement Report pages now load faster, allowing investors to access key investment data more quickly. Improving platform loading times aligns with Lendermarket’s overall goal of continuously enhancing the user experience on the platform.

Lendermarket has updated its website, improving the interface, structure, and content. The website now features a modern and intuitive layout, making navigation easier. These updates were introduced to provide investors with a more convenient and user-friendly experience.

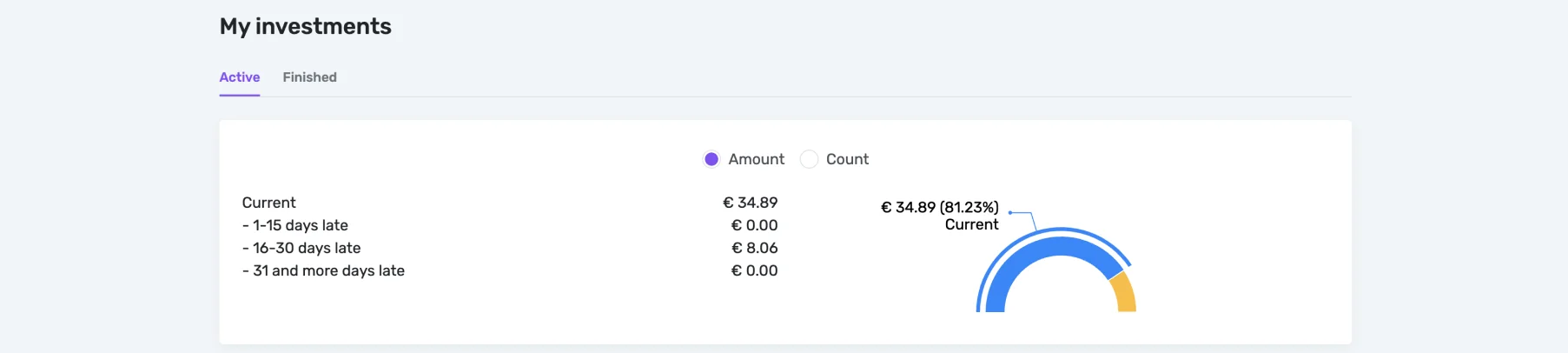

The “My Investments” report has been upgraded to include additional details and improved sorting functionality for both active and finished investments. These updates are designed to provide greater insights and facilitate easier data analysis for your investments.

The Lendermarket platform is now fully available in Finnish. You can also opt to receive emails in Finnish via your settings. This localization aims to better support the emerging Finnish investor community.

You can now select your preferred language within the investor portal. Once set, all emails from Lendermarket will be sent in your chosen language. This update enhances user experience by providing localized communication tailored to your preferences.

The Auto Invest setup process now displays the number of available loans that match the selected criteria. This enhancement was introduced to help you choose an Auto Invest strategy tailored to your investment goals and the loan supply available on the platform.

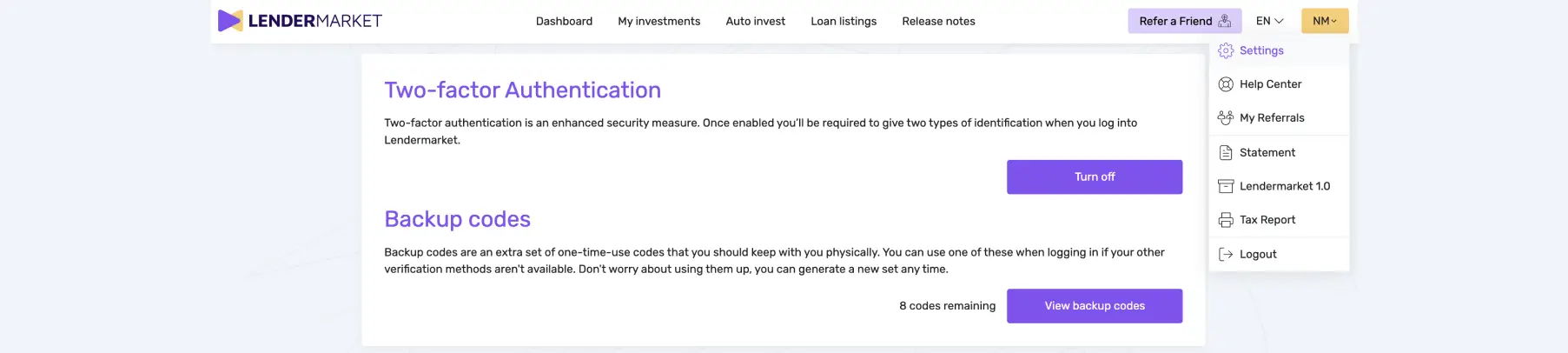

We’ve integrated two-factor authentication into investor accounts on Lendermarket 2.0 to provide an added layer of security. This feature was developed to enhance security during the sign-in process.

We’ve introduced a downloadable “My Investment” report that includes details on both active and finished investments. This report allows investors to easily track the lifespan of their investments and compare them at any stage. This feature was created to help investors access investing-related information more conveniently.

It is now possible to request a loan-by-loan breakdown of Pending Payments Interest from our Support and Investor Relations Team. Contact us at: [email protected]. This enhancement was developed in response to investor requests.

The Statement Page is now downloadable in .CSV format, following feedback from investors seeking to analyse their returns. This downloadable report offers precise data, such as investment-based transaction details, which was not possible on our older platform that focused on loan-based information. Investors can now analyse returns, even on individual investments made at separate times within the same loan. Additionally, two date columns have been added to the .CSV format report to enhance visibility and clarity, ensuring any potential delays are easily identifiable. This level of detail was not possible on Lendermarket 1.0, so we are very pleased to provide it in Lendermarket 2.0. UI updates to the Statement Page are planned, alongside similar functionality for the My Investments page. This enhancement was developed in response to investor feedback on the board regarding data access and reporting. We are committed to exceeding expectations in this area.

A new sorting feature on the Loan Listings page has been introduced. This enhancement was developed in response to investor feedback, with the goal of simplifying and improving the manual investment process.

A dedicated landing page has been launched for friends referred through your unique referral link. This new page is designed to provide your referred friends with valuable information about investing on Lendermarket, helping them get started with confidence. Refer a friend.

A design upgrade across the Lendermarket investor portal has been implemented. Changes were made throughout the platform, with significant updates to the Investor Dashboard, the Refer a Friend page, and the Auto Invest page. These improvements aim to enhance the user experience, making it easier to understand and invest on the Lendermarket platform.

Lendermarket investors are now able to invite friends to invest on Lendermarket 2.0, with both the investor and their friend receiving a 1% cashback bonus. You can invite your friends and learn more about the referral bonus here. This update provides Lendermarket investors with the opportunity to earn additional returns.

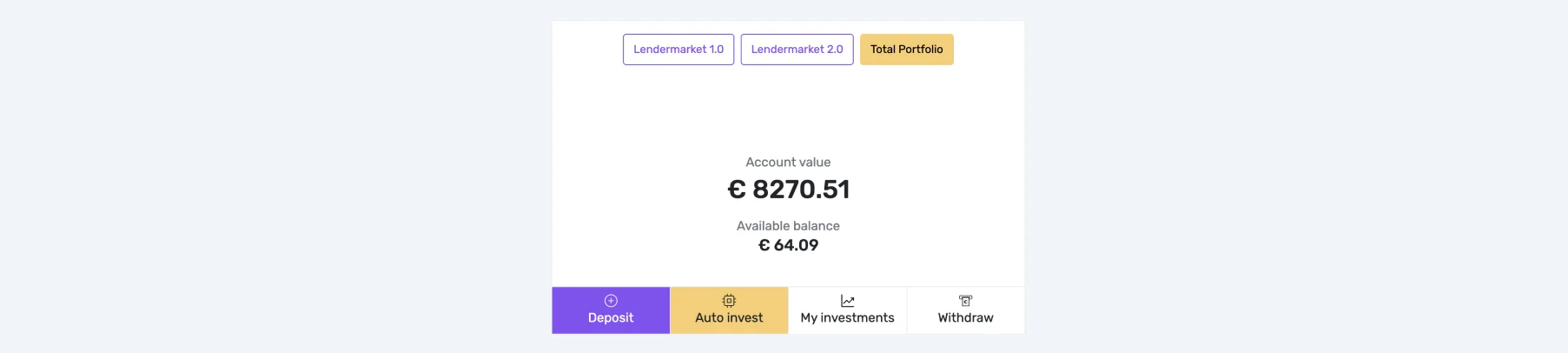

The Investor Dashboard now combines information from both Lendermarket 1.0 and Lendermarket 2.0. Investors can select specific data from either version. This update makes it easier to read and understand investment information on the dashboard.

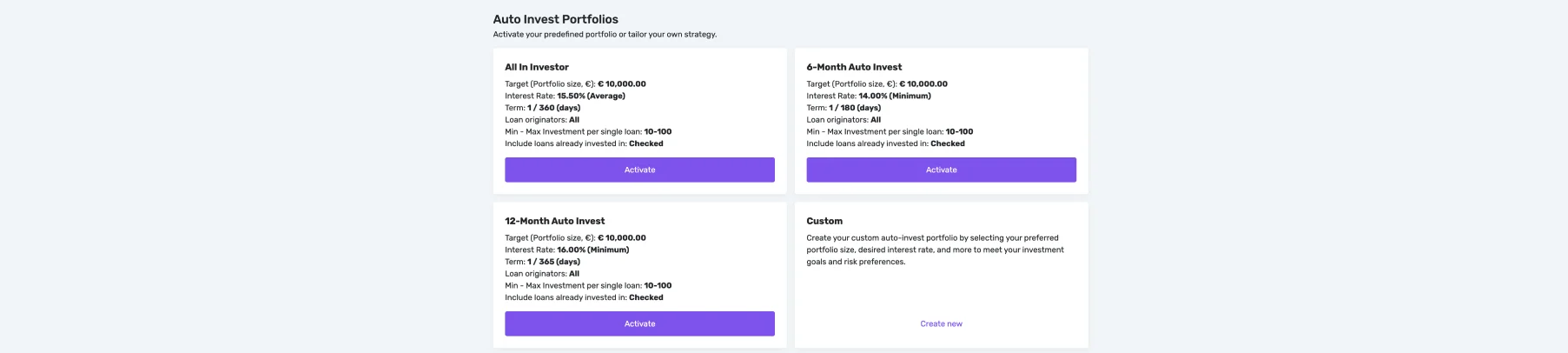

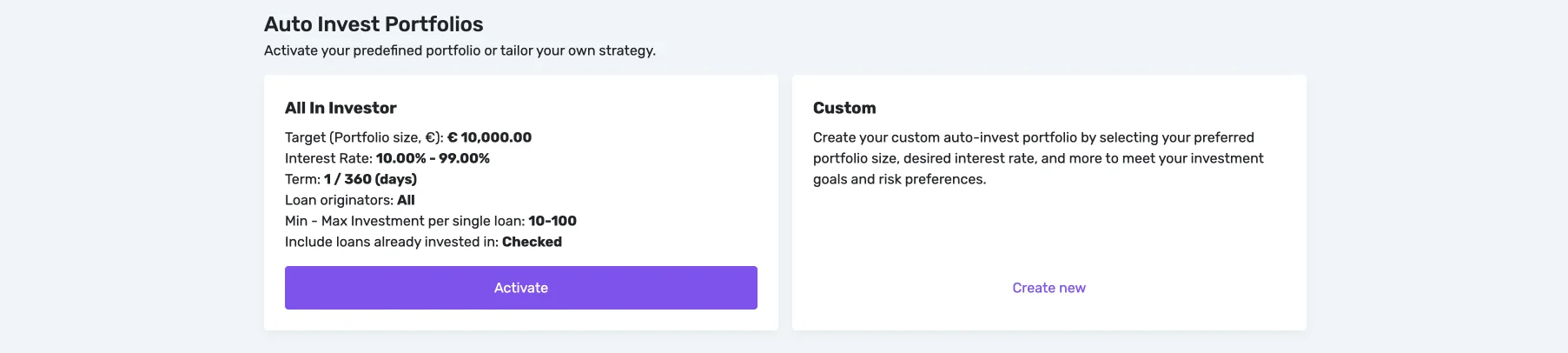

3 distinct pre-defined Auto Invest portfolios are now available on Lendermarket 2.0. Investors can easily activate the Auto Invest feature with a single click or opt to design a personalised strategy. This enhancement simplifies the setup process, enhancing speed and convenience for investors.

Investors now have expanded options for editing their account settings, including updating their residential and email addresses directly from the settings page. This update aims to streamline account management processes, enhancing user convenience and efficiency.

The Predefined Auto Invest portfolio was introduced on Lendermarket 2.0. Investors can now activate the Auto Invest tool with a single click or create a custom Auto Invest strategy. This update aims to streamline the Auto Invest setup process, making it faster and more convenient for investors.

The investment portfolio summary now has more information and is located on the “My Investments” page. It includes data visualisations and the number of loans invested in. This update makes it easier to read and understand your investment statistics on the dashboard.

The deposit page design and content have been streamlined. This update focuses on enhancing clarity and simplifying the explanation of the deposit process for our investors.

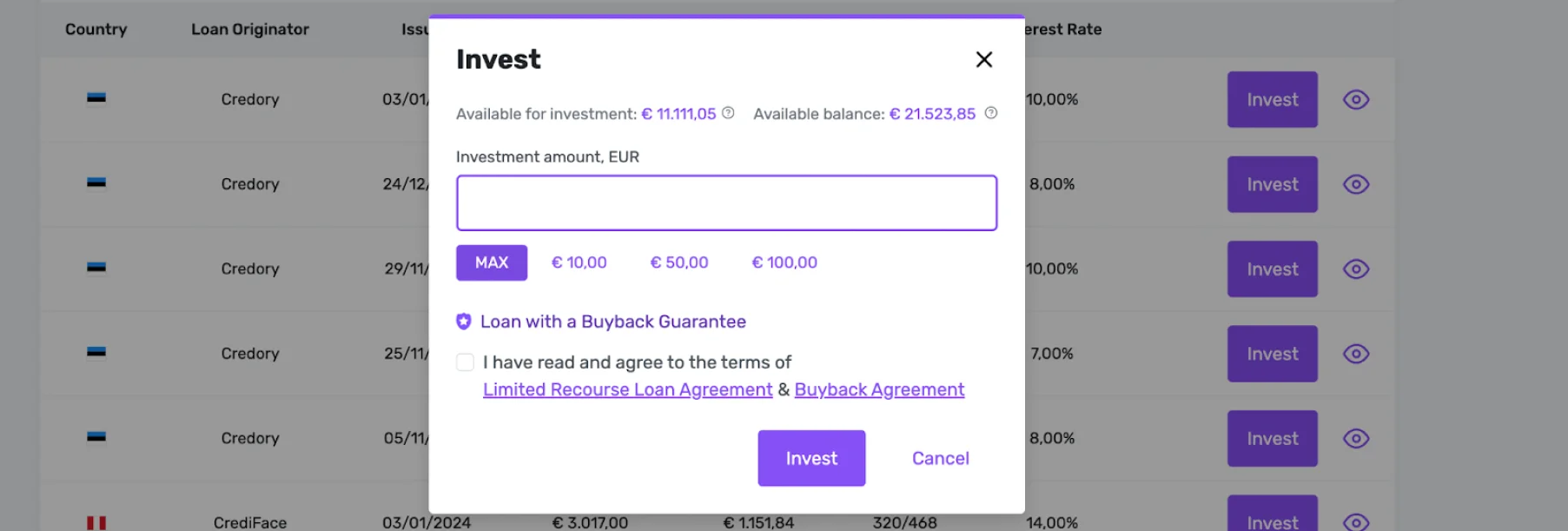

A MAX button has been added to the manual investment process, allowing investors to invest the maximum available amount in a single loan.

The “transferred balance from LMv1″ (Lendermarket 1.0) is now shown at the top of the “Statement” page. The Account Statement Date now defaults to the setup date. This upgrade allows investors to view statement details from when Lendermarket 2.0 was introduced, including highlights of balances transferred from Lendermarket 1.0.

Investors can now create a new Auto Invest portfolio in just 2 clicks. When setting up a new Auto Invest portfolio, investors will find default values already filled in. They can either confirm the Auto Invest with these pre-filled values or make adjustments as needed. The change was implemented to simplify the Auto Invest set-up for investors.

Pending Payments interest calculation changed from daily to monthly.

Previously, Pending Payments interest was calculated daily, resulting in a daily increase in your Pending Payments value. Now, rather than observing daily increments, you will witness the increase once per month.

The formula for Pending Payments interest is as follows:

(Daily rate) x (Days of Pending Payment) x (The amount)

Daily rate: 0.18/360 = 0.0005 (this is a fixed rate and same for every investment)

Days of Pending Payment: It is the number of days the amount remains in PP. (Days of Pending Payment can be calculated like that: date Pending Payment is released – date Pending Payment is created – 10 (10 days is because of the grace period.))

The amount: It is the amount that stays in Pending Payment.

For example, instead of experiencing a daily increase of 1 EUR, you’ll see a cumulative increase of 30 EUR at the month’s end. To see Pending Payments details, navigate to the Pending Payments account statement.

This change does not affect your earned interest from Pending Payments.

The change was implemented in order to fix calculation errors that required balance adjustments and to simplify tracking of interest earned from Pending Payments for investors.

10th May, 2024

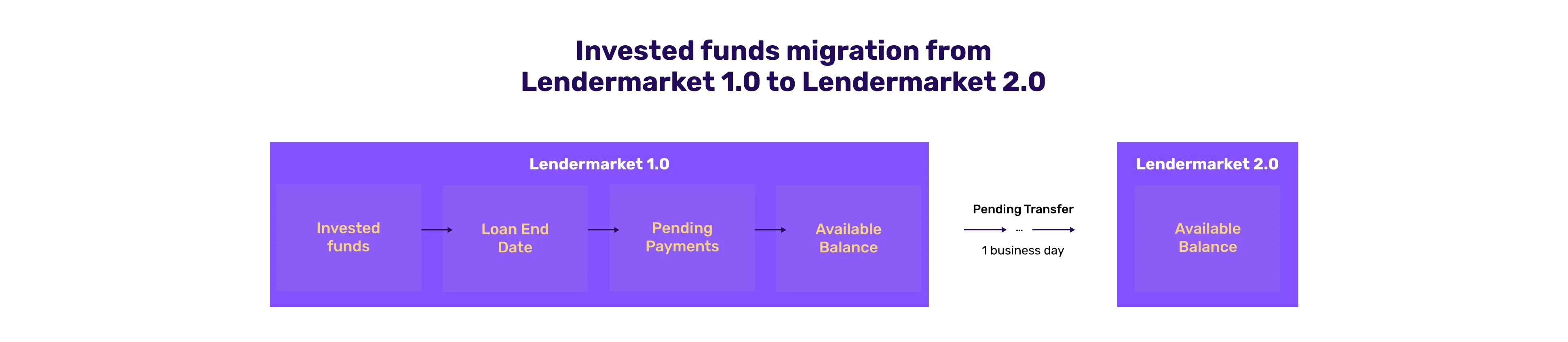

“Invested Funds” in Lendermarket 1.0 will remain in Lendermarket 1.0 until the loan/s reaches the end date.

Once loan/s end date is reached, your funds may enter the “Pending Payments” stage before it is released to the “Available Balance”. That amount is shown in the “Pending Payments” section of the Lendermarket 1.0 Summary.

Your “Available balance” from Lendermarket 1.0 will be transferred to Lendermarket 2.0 on a daily basis.

Note: Funds migration from Lendermarket 1.0 to Lendermarket 2.0 is an ongoing process which is facilitated by Lendermarket and does not require any actions from Investors.

10th May, 2024

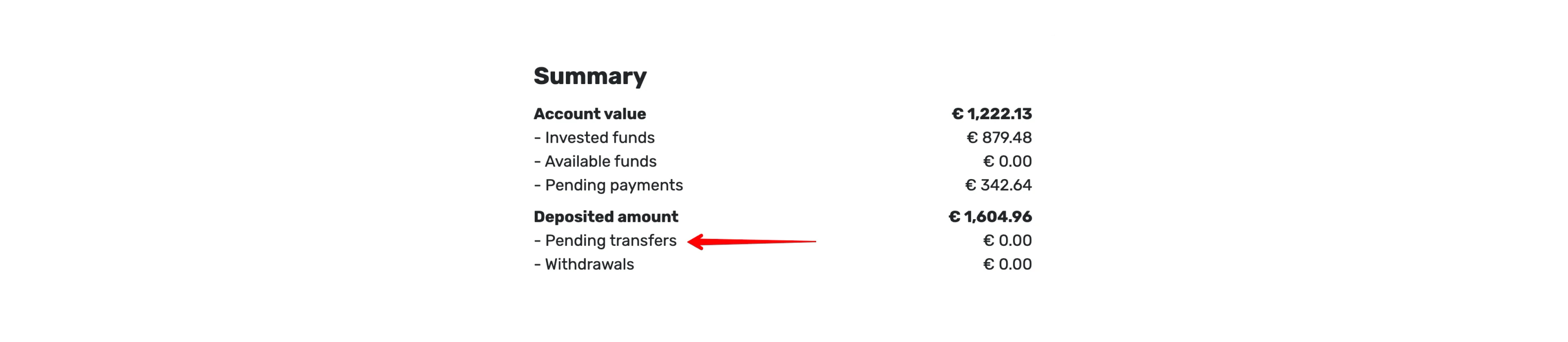

Your Available Balance from Lendermarket 1.0 is transferred to Lendermarket 2.0 daily.

To see the Available Balance amount to be transferred:

This amount is queued for transfer from Lendermarket 1.0 to Lendermarket 2.0.

No action needs to be taken by the investor for this transfer to take place.

10th May, 2024

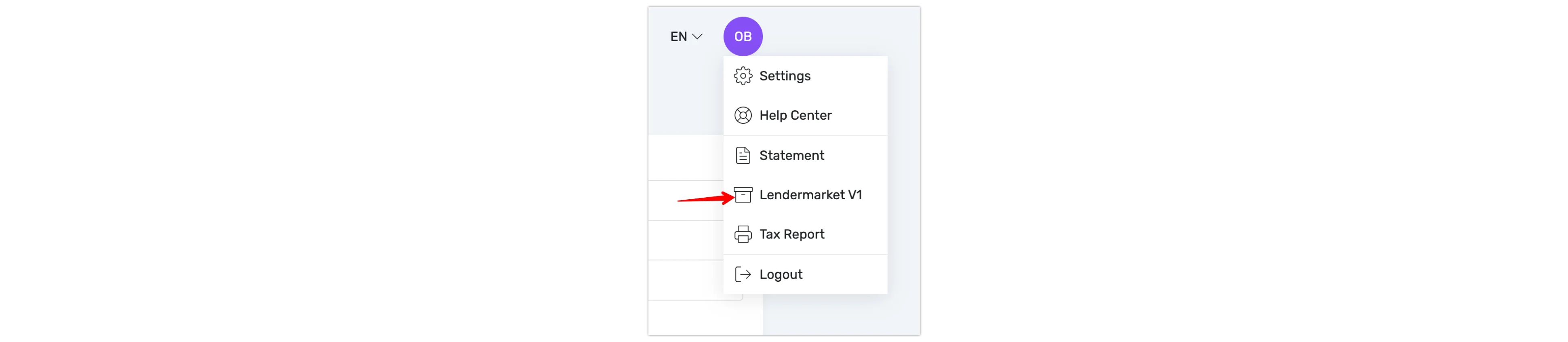

Navigate to the Lendermarket 1.0 dashboard using the investor settings menu.

Access Lendermarket 1.0 for: