Investing in the Future: How Lendermarket and Our Investors Drive Social Impact

Investing in the Future: How Lendermarket and Our Investors Drive Social Impact At Lendermarket, we believe that investing is ultimately about the future. It

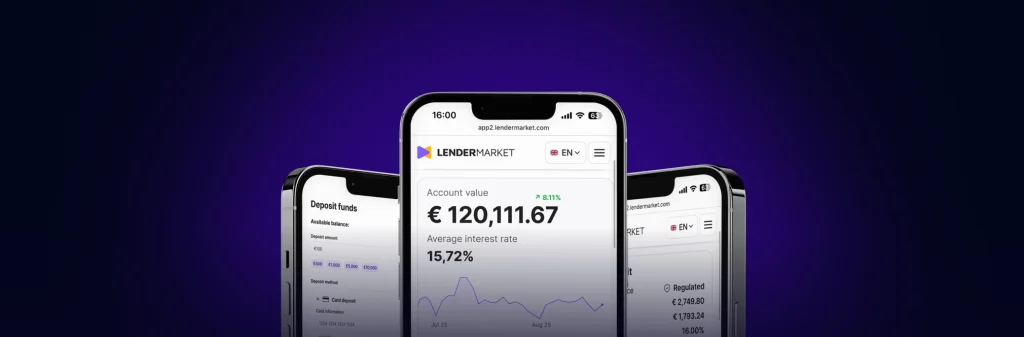

Lendermarket is tailored to meet the needs of investors across Europe. Switch the language in the top navigation bar to access localised insights, resources, and updates for your region. Investing made easy—wherever you are!

Investing in the Future: How Lendermarket and Our Investors Drive Social Impact At Lendermarket, we believe that investing is ultimately about the future. It

Something Good Is Meant to Be Shared Share the Love. Grow Together. There’s something uniquely rewarding about sharing something that matters, whether it’s a

This memo explains the introduction of Gatelink International OU (“Gatelink”) as an independent Loan Originator for certain offers involving but not limited with Creditstar-related

Promotional Campaign Think Forward: A Smarter Way to Start Your 2026 Portfolio Growth The start of a new year is the perfect time to

Upcoming Changes to Certain Deposit and Withdrawal Transactions: What You Need to Know We’re updating the Rules of the Platform, effective February 1, 2026,

This December, you can boost your holiday season with a cashback bonus of up to 3% when you invest newly deposited funds through campaign-exclusive

Saving has commonly always been considered a virtue: a sign of common sense, discipline, and foresight. But what was once considered a solid cornerstone

11.11 Lucky Number: Turn Your Wish into Returns You’ve seen it before – 11:11. A number linked with alignment, luck, and opportunity. At Lendermarket,

Today, we are marking a significant milestone in that journey: the announcement of the official closure date for our legacy Lendermarket 1.0 platform, and

Your bonus is waiting: Refer and Earn