Oh, there we go, everyone’s favorite topic: taxes. Jokes aside, doing your taxes and making sure everything is as it should be is an important part of every investors’ work (or their tax accountants). Because, as you know, you don’t want to get in trouble with tax authorities.

So in this article we’ll highlight some things that you should know about tax declaration as a retail investor, so you are prepared for when tax season comes around. We’ll discuss what documents you may need, when a taxable event can happen in P2P lending, and if losses are deductible.

Important note: Lendermarket is not a tax advisor, and the tax laws in every country are different. Therefore, the following information should be seen as a general guide on how to handle your taxes, not as tax advice. The details will likely differ in your unique case, and thus it’s best to consult a tax professional that’s allowed to practice in your country, to be sure you perform all your duties correctly.

P2P lending taxes – the basics

In the following section, we want to discuss five basic questions that can help you get a rough idea of how to handle your taxes when investing into P2P lending. Keep in mind that this is a general approach and no substitute to tax advice.

Do I need to pay taxes on returns from P2P lending?

In most countries, you need to pay taxes when you earn money. There are some exemptions or different cases like an inheritance, but if you work to earn money or invest, then the gains you make from that have to be taxed.

There are some tax advantages accounts where taxes are only due after a certain time period or that incur a lower tax rate, but in general, the money you make from the P2P lending returns will have to be taxed.

When do I have to pay taxes?

The topic of when to pay taxes is difficult and there multiple ways that it is handled:

- When the returns are credited to your account

- When you pay out money to your bank account

Depending on which way you choose to use, or your government uses to track your taxable P2P income, the amount of tax due differs. More on that in the next section.

You then need to pay taxes once your tax season comes around. This is usually the year after you made the gains when you file your income tax return and mention your gains. If you use a tax advisor, the due date can also be postponed, or you perhaps have a multi-year period anyway where you can file the report.

How much tax do I need to pay?

How much tax you need to pay mainly depends on the tax rate that is applicable to your P2P gains. In some countries, these returns are taxed with your personal tax rate, others use a tax rate specifically for any earned income acquired via investing (capital gains).

Therefore, your tax rate is a very country and case-specific metric.

Furthermore, the amount to pay tax on depends on if you must pay tax only when you pay it out or at the moment the returns are distributed to your P2P lending account. In the latter case, you pay taxes more often, whereas in the former you could pick a time to pay out the returns where it’s suitable for you.

Do I need to pay taxes even if I reinvest my earnings?

This is very dependent on the country you’re living and have to pay taxes in, but in most cases yes. The majority of governments require you to pay taxes on the gains you made with P2P in that year, basically following the first method mentioned above where the tax is due once you receive the returns in your account.

If the second method is used where you only pay money once you have it paid out to your account, you will eventually also need to pay taxes, but perhaps only years down the road.

Which method can be used in your country should be discussed with a certified tax accountant.

Can I deduct my losses from P2P lending?

You know the gist: It depends. Often the regulation doesn’t allow you to deduct P2P losses from other income streams or capital gains, but it depends on the laws and whether you can prove to the tax authorities that the defaulted loan is unable to be reclaimed.

What do I need to submit my tax declaration?

When you want to submit your tax declaration, you most likely need the following documents:

- A tax or account statement from your P2P lending platform

- The correct form for your tax declaration

- The total amount you earned from P2P investments

With all these prepared, you can either file the specific form with your tax declaration or you enter the number in your general tax return. Some tax authorities require you to send the proof for the earnings as well, whereas for others, you just need to be able to show it if asked for it.

How do I calculate my taxable income?

In the case of Lendermarket, it’s easy to calculate the taxable income:

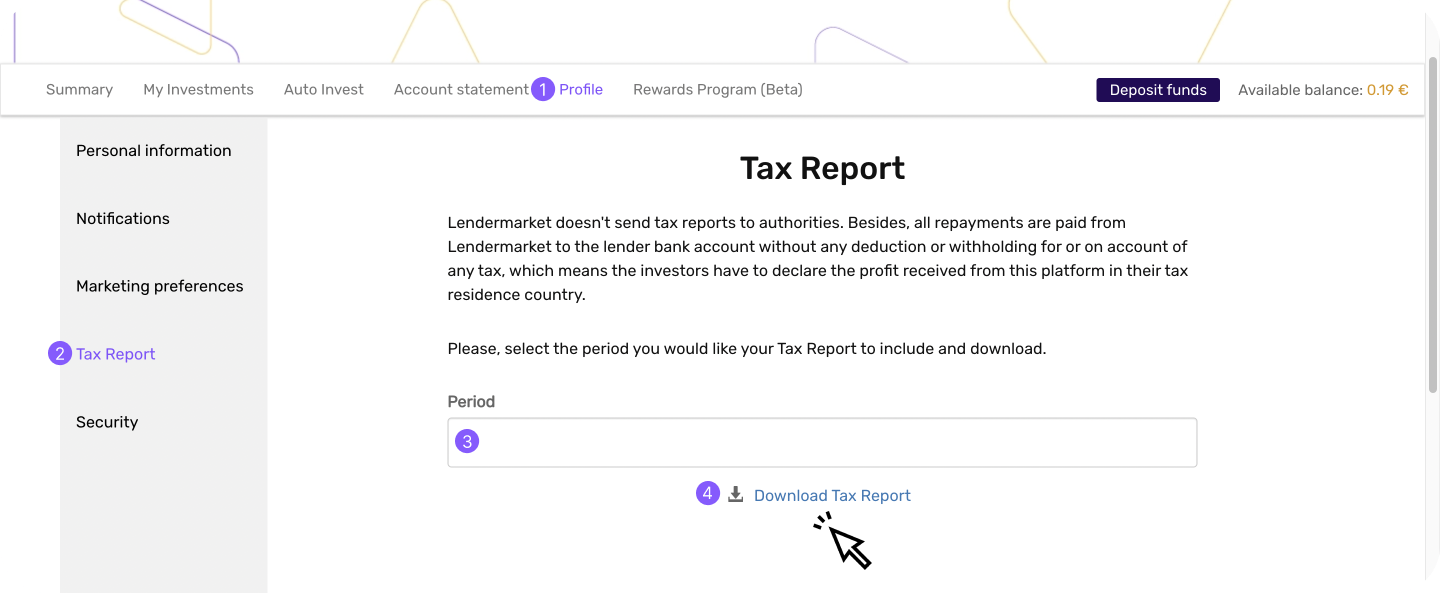

- You log into your account and choose “Account statement” from the top menu

- Define the period for which you need the taxable income by selecting the start and end date

- Add together “Interest received”, “Delayed interest received” and “Campaign rewards and Bonuses”

- The sum of these three items is the total amount of taxable income you need to pay tax on

Bottom line

Taxes can be a tricky topic. We hope that if you read through this article, you understand the basics about when and how to pay taxes when investing in P2P. The bottom line is, that most countries require you to pay taxes on the returns you made every year, but it’s best to consult a tax advisor if you have any questions.

Lendermarket makes it easy for you to see your taxable income in a matter of seconds, so you don’t need to worry about it eating up loads of your time.

Have fun investing into P2P, and we wish you good returns!