Everything comes and goes in waves: The trees blossom, bear fruits, and then drop their leaves until the following spring. The tide of the water rises with the flow and declines with the ebb. These principles that hold true in nature can also be applied to investing.

Economic phases follow a cycle, with different phases that usually follow each other and repeat over the course of history. After reading this article, you’ll be able to understand different market phases and can use that understanding to make better investing decisions.

Understanding market cycles

Before we go deeper into the tips you can take away to make a difference in your own investments, it’s important to understand the different market cycles.

4 Phases of a Market Cycle

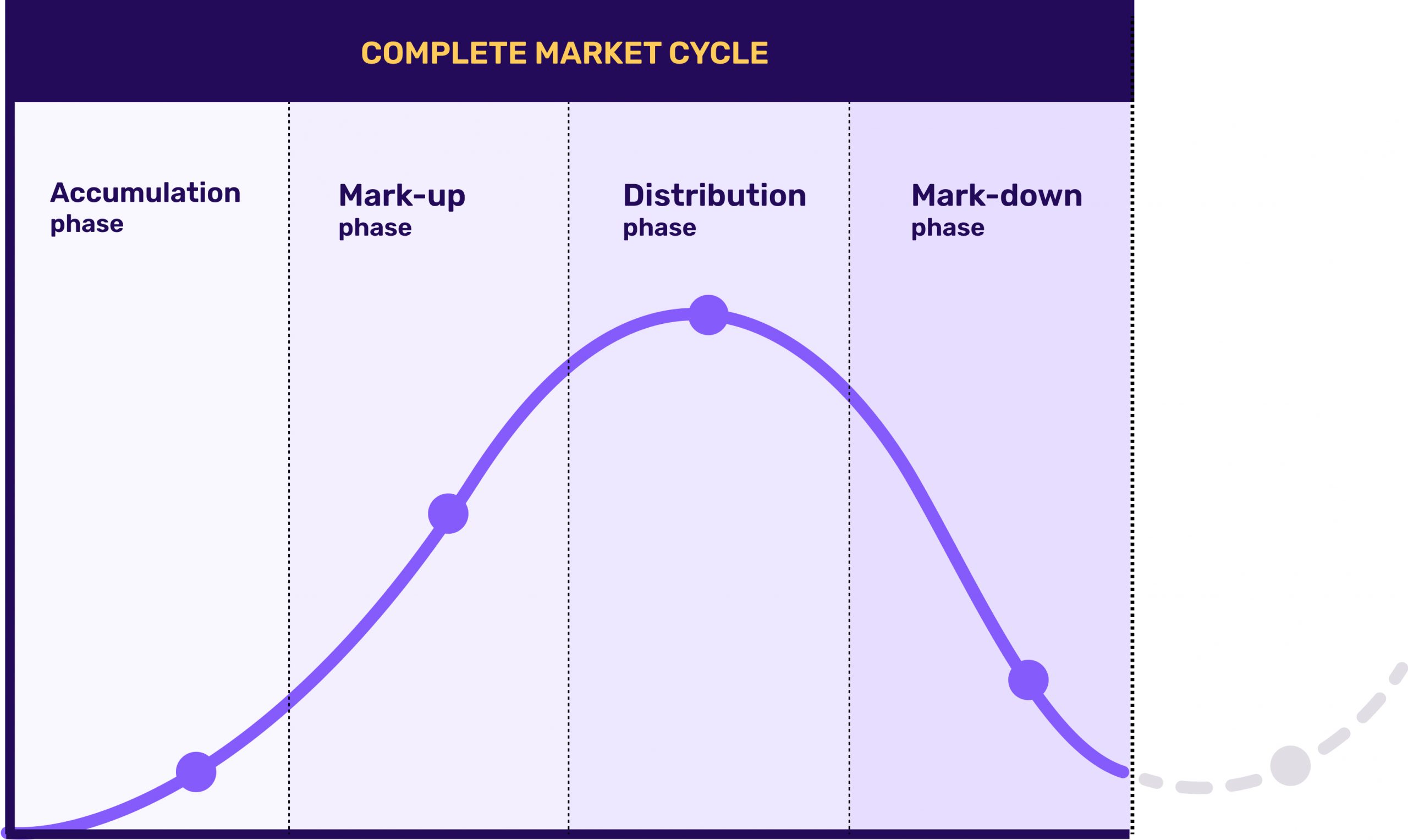

Every market usually goes through four distinct phases, which come after one another and reappear in the next cycle: The rise, peak, dip, and bottom. Now let’s look more closely at the characteristics of each phase.

The accumulation phase (The Rise)

In our diagram, you can see that this phase follows the bottom-phase. Early investors feel like the worst of the market downturn is over and begin buying again – a smart move, considering they can get everything at a discount because people were eager to sell in the previous phase.

In this phase the price rises slowly because it reached a level where for everyone selling, there is someone else to pick up their sales, knowing they’ll profit in the long run.

The mark-up phase (The Peak)

During this stage, investors and the public begin regaining confidence in the market because prices were at a relatively stable level. More people get in, and also the media publishes articles that the worst part is over, and therefore it might be a good idea to invest now.

Prices rise and rise, which creates FOMO (fear of missing out), and leads to even more people investing. When in the last phase the sentiment in the market was rather negative or neutral, in this phase it’s euphoric.

The distribution phase (The Dip)

After the peak has been reached, investors are looking to get rid of their holdings and sellers dominate. While everyone has just been partying emotionally during the mark-up phase, there are now mixed emotions coupled with uncertainty.

What way the markets will take is unclear to the masses, but from a bird’s-eye view the general direction is a downward trend. If unable to sell your holdings for profits, many investors try to sell at breakeven or a small loss, to get out of the pickle.

The mark-down phase (The Bottom)

As the name implies, markets are now going down, and the sentiment mirrors that. This is an unfortunate situation for everyone who hasn’t yet been able to sell their investment because it means high losses.

To the person who got in on the hype-train and collected their first experiences in the market, this could mean they will not touch investing again for a long time, due to the fear of getting burnt again. For the seasoned investor however, this is a signal that the bottom is near and an opportunity to fill up the bags awaits.

Investing during different market cycles

As you can probably tell, if you keep the same behavior during each of these phases, it will most likely lead to a different outcome. Hence, why it is crucial to adjust your investment strategy accordingly to fit your goal and the current market conditions.

Below we’ll share some tips of common investor mistakes, what you can do during a market decline and how you can manage your emotions during such a phase.

Common investor mistakes

There are a few common investor mistakes that both beginner but also experienced investors make:

- Thinking during the mark-up phases that prices will continue to rise indefinitely

- Buying high (at the peak), and selling low (at the bottom)

- Letting emotions lead the way of the investment decisions (more on that in a bit)

- Interpreting a mark-down phase and bottom as the end of the journey, after which prices won’t ever rise again, and therefore pre-emptively selling your investments at a loss

- Not having a set goal when to take profits and thus waiting too long and lose out on potential wins

What to do during a market decline?

As you learned in the beginning, a declining market where prices are going down is usually a great opportunity to buy. Investors are keen to get rid of their investments and in turn even accept selling them at a loss. This drives prices down and opens up a chance for you to get in on a discount.

However, if you’re the one holding your assets during that time, it can be difficult to not be swayed by the general market sentiment and sell everything. Sure, certain investments could break the market cycle and not recover, this is always the case when investing into single stocks or sectors.

But if you invest diversified and have the conviction that over a long period of time the stock market will perform positively, then it’s time to manage your emotions and stick through it. Play it defensively.

Managing emotions during a market decline

Seeing your portfolio in the red has an influence on your emotions, no doubt about it. What can help you get through it is focusing on the market principles that everything happens in cycles and looking at history. In the last 100 years, we went through many ups and downs, but in the end always recovered.

It can also help to get your mind off these things, by not taking a look at your portfolio during that time, but instead spend more time with friends, family and activity you like. It sounds trite, but it really helps!

Conclusion

Once you understand the economic cycles, they can help you make better decisions in your investments, namely:

- If the news, all your friends and acquaintances talk about investing now, markets might be in the mark-up phase

- When markets go down, it’s a good buying opportunity and also not a reason to sell all your assets

As with everything in life, investing and making good decisions while doing it come down to experience. Not just the knowledge of things, but also having gone through good and bad phases to know what they feel like, and that they’ll ultimately repeat. After every rain comes sunshine again.