Welcome to LATAM!

We are delighted to introduce you to our newest and fourth loan originator CrediFace.

CrediFace Perú SAC is a Peruvian Fintech with more than 6 years in the market, it owns the CrediFace and ValeCash brands in Perú and CrediOne in Mexico.

CrediFace finances Consumer loans to Individuals with tickets from USD$300 to USD$5,000 on average for terms of up to 24 months, focusing on Underbanked Dependent segments, with sustained growth characterized by a very low Default ratio (9% to 10%) and good management of the product’s profitability, having overcome the Covid crisis without major inconveniences.

CreditFace’s target market

CrediFace’s target market is underbanked customers, who have banking products but are poorly served. They serve Dependent and Independent clients as long as they do not have negative records in the Credit Bureau and their process is 100% Online to a single signature, making the volume and scalability necessary for the business to be profitable.

CrediFace was born with the slogan of having gradual growth prioritizing the quality of the Portfolio, being very careful in the evaluation maintaining an approval ratio of 8% approx. Its evaluation process contains algorithms that detect indebtedness, payment behaviour and other indicators that make it possible to have a robust portfolio against any external agent.

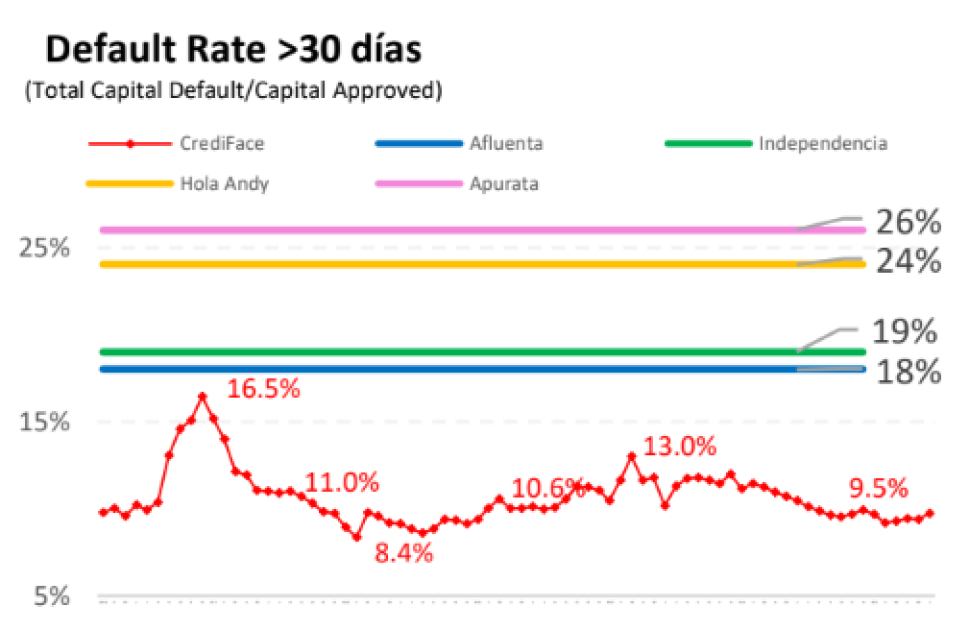

Thanks to their technology aimed at taking care of the portfolio, they maintain a Delinquency ratio of approximately 10% (out of 100 disbursed clients, only 10 exceed 30 days in arrears), well below other Fintechs.

CrediFace’s growth is sustained closing 2021 with Revenues of USD 478 thousand and this 2022 is projected to exceed USD 700 thousand. Profitability is measured by the Balance Due/Income ratio resulting in 19% (only 19% Income will cover Delinquencies), this indicator being a maximum of 30% in traditional Banking.

To start the cooperation, CrediFace will offer loans with yields payable of up to 16% p.a. All the listed loans will be covered with a 60-day buyback guarantee.

CrediFace’s detailed presentation and the company’s financials can be found in the Loan Originators section.

Log in to your account to diversify your portfolio with loans from Peru.