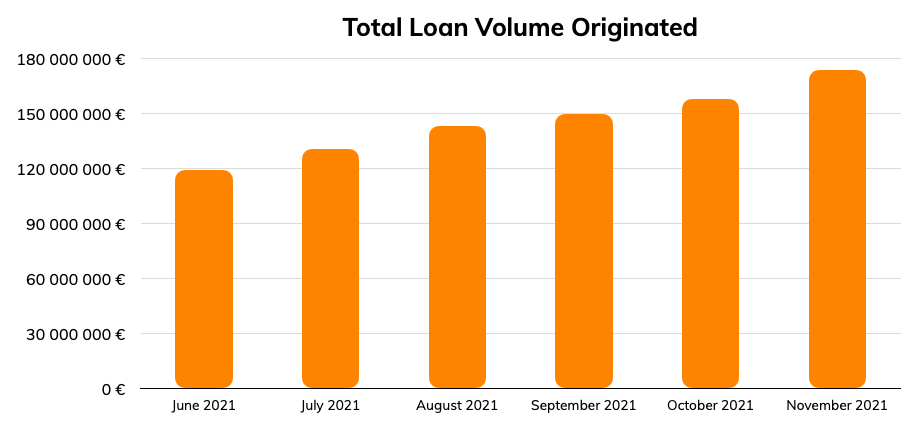

Total Loan Volume Originated shows the amount in euros that the loan originators made available to invest on Lendermarket. The graph below shows the cumulative loan volume originated in the last 6 months on the platform.

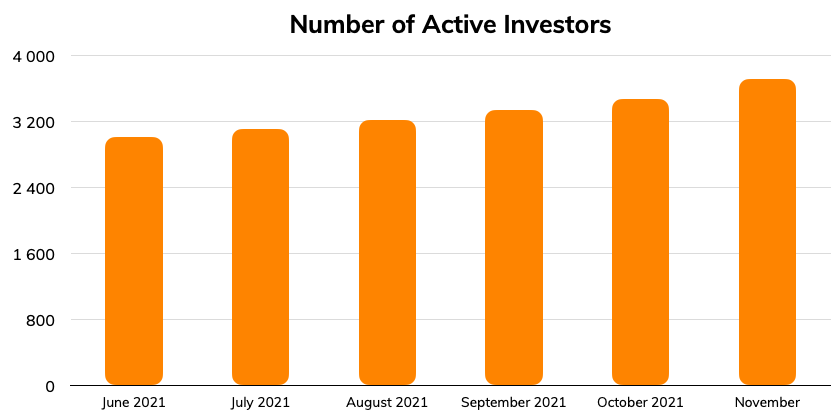

Active investors equal users that currently have funds in their investment accounts. The number of active investors has been growing steadily month by month.

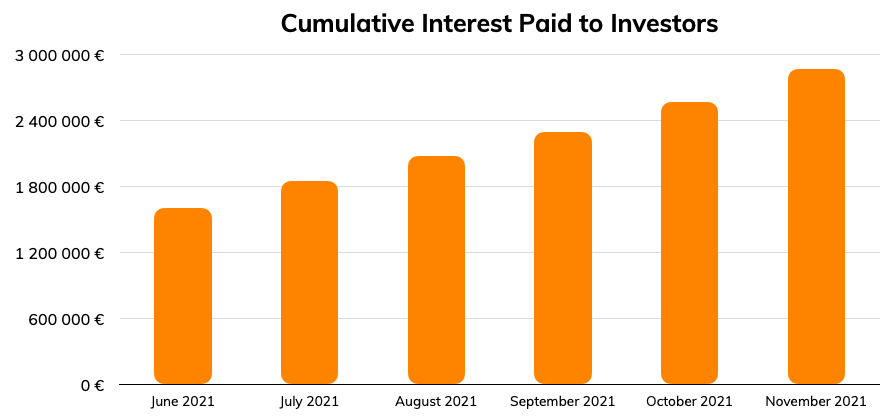

In the graph below we can see the amount of interest income earned by investors since Lendermarket started operations. The graph includes regular interest and delayed interest – interest received by investors when the loan is overdue.

Key Takeaways

We have helped our investors earn €297,132 in returns in November. We added 37,576 new loans to the platform last month. This means that our investors funded over €15,827,638 worth of loans last month, which is 240.53% more than the same time in November 2020.