Almost everyone will be confronted with debt at some point in their life, whether that’s through taking out a loan for a large purchase, to fund tuition fees, or helping a close friend or family member. For most of us, debt is not something we can handle easily.

In this article, we’ll share seven tips on how to get out of debt fast and show you how you can make guaranteed returns by doing so. Have fun!

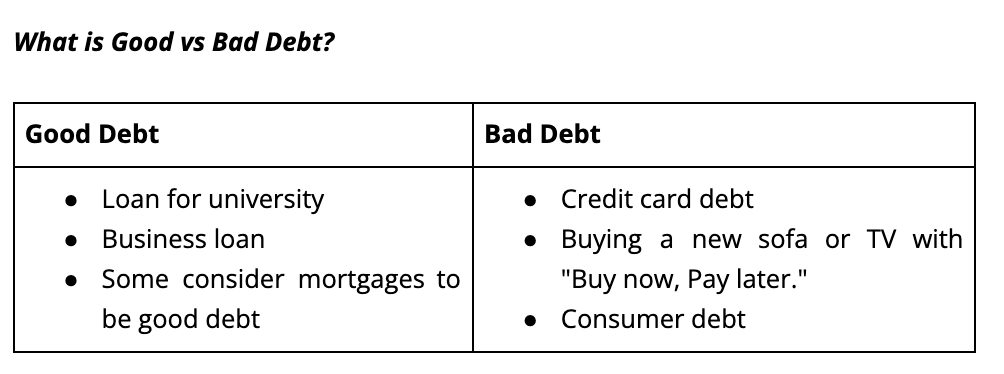

Good vs Bad Debt

Some people are against debt in any form. However, there is a significant distinction between good and bad debt. Good debt is the kind that brings you forward in life; for example, because you paid for university or took out a loan to build a business.

On the other hand, bad debt is mainly acquired by buying items on credit that you can’t afford, like a big flat-screen TV or a new sofa for your living room. This consumer debt only weighs you down and is unnecessary.

Good debt tends to offer better interest rates than bad debt, which is sometimes put on credit cards that charge huge fees. So in the following table, we’ll show some examples of good and bad debt so you can get a feel for the different types:

7 Tips on How to Get Out of Debt

Now that you have an idea of which debt makes sense to take up and which to get rid of as soon as possible, we’ll share seven tips on how to get out of debt faster.

Track your spending

To know how much money you have every month to set aside for debt repayments, it’s paramount to know your general spending and income. Income is likely easy; you can use your salary for that. But what about spending?

Use an app, spreadsheet, or even a pen and paper and note down all your spending for 1–3 months. This will give you a comprehensive overview of your spending habits and enable you to find ways where you could save and get out of debt faster. Financial planning plays a significant role in your success!

Create an Avalanche and Throw a Snowball

Avalanche and snowball both refer to a specific method of debt reduction. With the snowball method, you pay off the loan with the smallest value first, then the next largest one, and so forth. The focus lies on building momentum.

Utilising the avalanche method, the loans with the highest interest rates are paid off first. So, figuratively speaking, the debt topples in on itself.

While the avalanche method enables you to pay debt off the fastest and pay less interest, the snowball method allows you to build momentum and see success. Ultimately, the method you choose will depend on your personality type

Consolidate your Debt

If you have multiple credit cards, bank loans and other obligations where you need to pay back debt, all with varying interest rates, it can make sense to consolidate your debt into one large loan.

While this leads to you having one significant debt position instead of many small ones, it can be very effective to shrink interest payments if you have several high-interest loans (e.g. credit cards).

A debt counsellor can help you formulate a strategy to consolidate your debt and help arrange a consolidation loan from a bank.

Unable to Pay Back Personal Debt? — Be Proactive!

Having debt and being unable to pay it can feel paralysing – especially if this is the first time you are experiencing this issue. Yet not doing anything and choosing to be passive is a counterproductive measure.

Your creditors might end up charging extra fees or getting a court order to make you pay. By being proactive and talking to your creditors about what happened and informing them that you’re not going to be able to pay, you can find alternate solutions.

This could take the shape of lowering your rate from 100 EUR a month to 50 EUR a month or putting payments on hold for a certain period. Most people are very understanding if you make an effort and are honest.

Prioritise and Automate Debt Repayments

Depending on the kind of debt you have, you should prioritise paying it back to earn guaranteed returns. For example, if you have credit card debt of 2000 EUR at 16%, then you’d have to pay almost 27 EUR in interest each month.

By setting up an automated transfer to your credit card company as soon as your salary comes in, you’re effectively making 16% returns, since you’re prioritising your debt repayments.

Use Surprise Payments for Debt

Perhaps your budget is tight and your monthly expenses match your income without any leeway. In this case, all cash flow is allocated for and debt repayment is slow. However, surprise payments, like cash gifts for your birthday or one-time vacation pay, can make a huge difference.

This is money you didn’t count on to fund your lifestyle in the first place, so why not use it to repay the debt and create a better future?

Get a Shopping List

We know this sounds very grandma-like, but the truth is, it works! If you go shopping on an empty stomach, you tend to spend more money and even buy more non-food items.

Making a shopping list in advance to know what you need helps you to only buy the things you planned for and not spend on non-necessities. Also, it reduces food waste, as you’ll likely have some ideas about what to do with the food you’ve written down.

Should you Invest while in Debt?

Whether to invest when in debt or not comes down to two things:

- How high is the interest rate on your debt?

- What personality type do you have?

If you have low-interest debt of 1—2%, perhaps from a student loan, then it could make sense to pay this back slowly and only pay the minimum while still investing in stocks, P2P loans or another asset class. If it’s high-interest debt of 10%+, you’re likely better off repaying it first.

But your personality also plays a role. If you’re someone that can’t sleep when having debt, regardless of whether it’s good or bad debt, then repaying it fast probably offers you more upside than investing on the side. Ultimately, it all comes down to your unique situation.

We hope this article can provide you with some insight and tips on getting rid of debt quickly. If you’re in a pickle, don’t hesitate to reach out to a debt counsellor or a person you trust and ask for help. It’s a healthy sign if you’re able to acknowledge you can’t do something alone!

Best of luck!