We are glad to inform you that Lendermarket has introduced new features to our platform that will provide you with greater access to valuable data related to Pending Payments within your investor account. Moreover, you can now manually reinvest your Pending Payments. Let’s take a closer look at these enhancements:

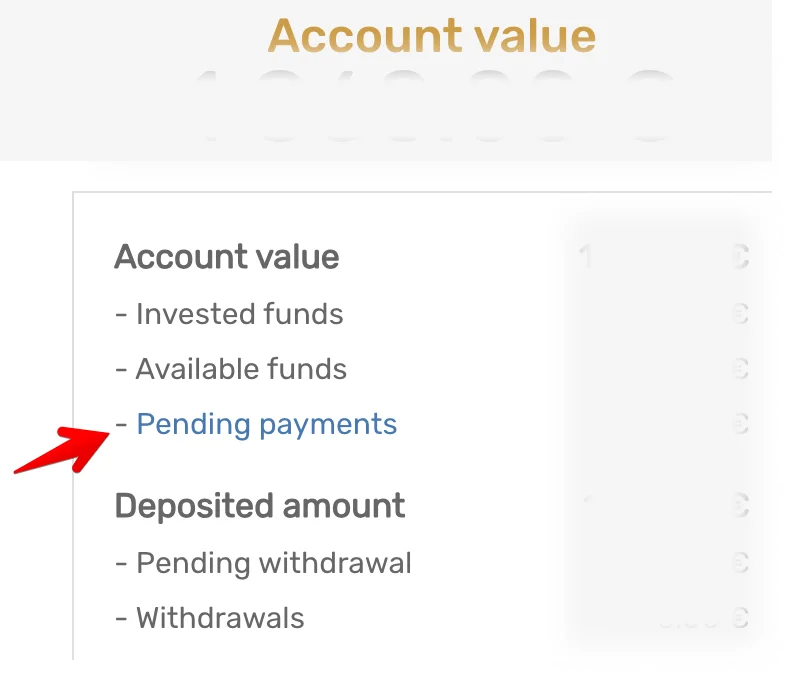

Enhanced Pending Payments Data Access

You can now access more in-depth insights in the Account Statement for Pending Payments. To access this page, simply click on the “Pending Payments” hyperlink in your account dashboard. Here, you will find a comprehensive overview of your portfolio, including transactional information for each individual loan.

Manual Reinvestment of Pending Payments

You can now manually reinvest your Pending Payments in just three simple steps:

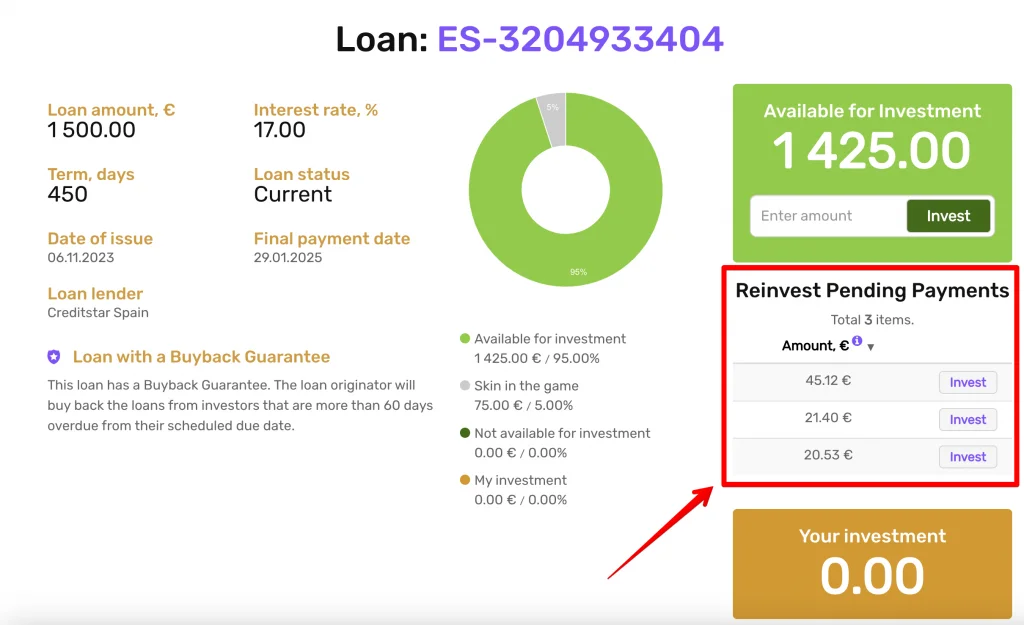

Step 1: Choose a loan by clicking on any available loan listed on our Loan Listings page.

Step 2: Once you’ve selected a loan, pick an amount to reinvest from the “Reinvest Pending Payments” table. Click on “Invest” next to the Pending Payment amount you wish to reinvest. Please note that you can only reinvest from the displayed Pending Payment amounts that are eligible for reinvestment based on your chosen LO and the loan’s Available Amount.

Step 3: Finally, read and accept the terms and conditions.

Example: