What is better – investing regularly or putting all your money in at once? In this article, we’ll cover the benefits of investing regularly and how you can use this strategy to your advantage. Have fun reading!

Use Dollar Cost Averaging

DCA, short for Dollar Cost Averaging, is the process of buying assets regularly with the same dollar/euro value, no matter their price.

To provide an example, let’s say you want to use Dollar Cost Averaging and have an amount of 500 EUR every month that you wish to invest into stocks. Then you will buy the chosen stock on the same day every month – no matter the share price.

So if the price for a share is 50 EUR, you will get ten shares. However, when it gets up to 100 EUR per share, you only get five shares for your invested amount.

Interestingly, due to buying on just these two occasions, you acquired a total of 15 shares for 1000 EUR – bringing your average price down to 66,66 EUR per share.

More info on the pros and cons of Dollar Cost Averaging can be found in our dedicated article on this topic.

A Regular Investment Controls Emotions

It’s easy to let emotions take the steering wheel when investing. There may be a great opportunity you just learned about and wish to invest all your money in. You might even skip the process of analyzing the investment first and making sure it can deliver what it promises. The result can be a win – but just as likely a loss.

If you choose to invest regularly and consistently put in the same amount, emotions won’t play as big a role. You permanently decide what asset you want to invest in, then follow through with that plan. This way you stay cool-headed and can view your investment objectively, rather than being caught up in the middle of it.

Low Barrier to Entry

To start investing nowadays, you don’t need to have 1000s of Euros available. Opportunities like P2P investing and stocks are available for small amounts such as 10 EUR. Notably, when investing in these opportunities regularly, some brokers offer them with no fees.

This makes the investment attainable for the masses and allows you to get your feet wet. You don’t need to save a considerable amount of money before investing. However, it’s a good idea to fill up your emergency fund beforehand.

By investing a small amount regularly, you can see and judge the performance and decide whether the asset is right for you.

You Keep Your Options Open and Stay Flexible

This flexibility of a regular investment allows you to alter your investment amount. You have the option to:

- Increase it

- Decrease it

- Temporarily halt the payment

- Stop the payment altogether

So if you feel that your initial strategy worked as intended, you can simply increase the monthly/quarterly rate that you invest. The same holds true if you have more money available now – maybe because of a wage increase.

But on the other hand, if times are tough and you lose your job, you can simply decrease the savings rate or halt it. A regular investment allows you to continually adjust it based on your everyday life and financial capacities.

You can also re-allocate and decrease the rate for one asset, whilst increasing it for another. You wouldn’t have that flexibility if you had invested all of your capital at once and are then bound to watch it develop on its own without intervention.

Put Your Investments on Autopilot

The most likely source of income people use for their investments is their salary. It comes in every month but is often spent on daily costs and consumption. If you invest regularly, you put your investments on autopilot and therefore use the saying “out of sight, out of mind”.

You just need to set up your investments so that once the salary comes in, there’s an automated amount that goes into your portfolio. That way, you prioritize your future over leisure spending; for example, buying stuff you don’t even value.

Investing on autopilot also frees up capacities in your mind you can then use to focus on other things. This could be developing your skills, spending time with family and friends, or shifting your attention to critical job-related topics. As soon as it’s set up, your portfolio will grow using the automated monthly investment amount, whether you pay attention to it or not.

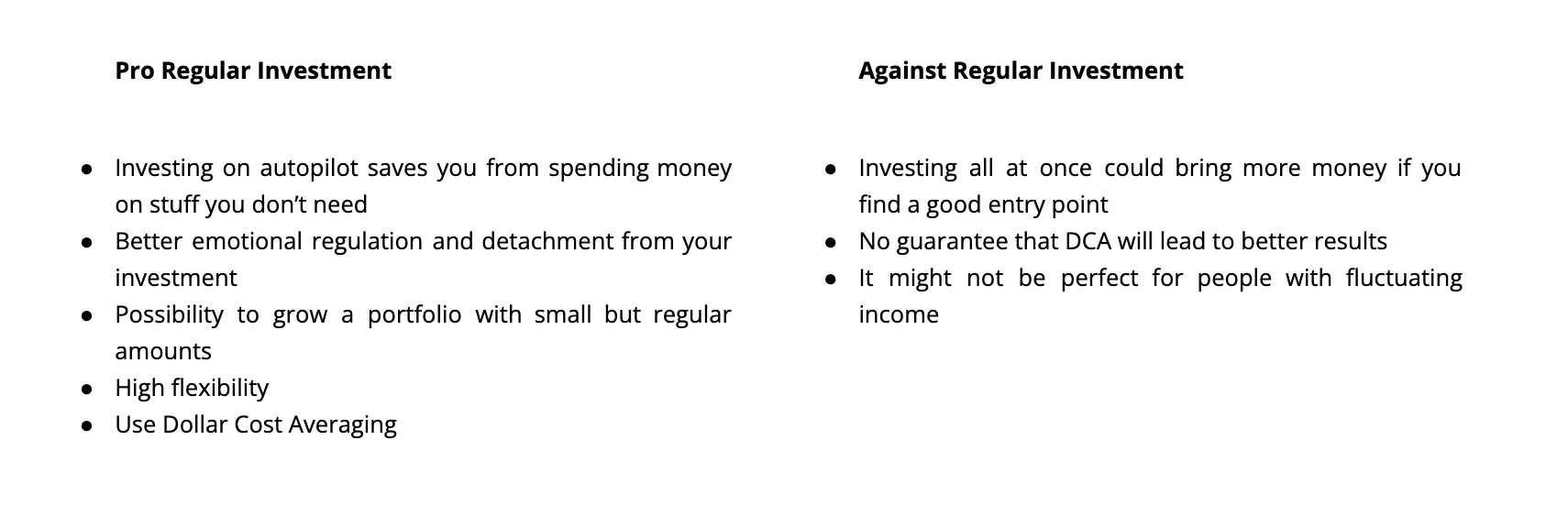

Pros and Cons of a Regular Investment vs All At Once

Let’s provide a better overview of the pros and cons a stable investment brings with it. The following table provides some points for and against this strategy that you should consider:

Conclusion

Investing regularly has many benefits – especially since you can use your monthly wage from employment to invest into your portfolio. You design a strategy for your investments once and then let it roll without thinking about it anymore.

There’s no guarantee that this approach will succeed; however, doing something regularly over a long period is, in many walks of life, better than doing it once. And as no one knows how the markets will develop, investing regularly ensures you benefit from both the highs and the lows.