Loans from Africa are now available on Lendermarket

Lendermarket is happy to welcome its third Loan Originator!

QuickCheck is a Nigerian Fintech company founded in 2017. It provides 24/7 loans to underserved Nigerian consumers and micro businesses through a mobile application. QuickCheck launched their device financing solution in 2021, offering hassle free lending processes which do not require lengthy application forms or any paper documentation.

It currently offers loans with a maturity between 30-360 days and the average value of NGN30,000 – NGN1,000,000 ($70 – $2400). QuickCheck constantly develops and invests in its operational capacity, loyalty building customer experience and cutting edge technology.

Their core technology is a proprietary algorithm that uses Big Data and Machine Learning to score clients automatically. By using a large amount of data to assess applications, QuickCheck is able to automatically determine the degree of probability that the applicant will repay the loan.

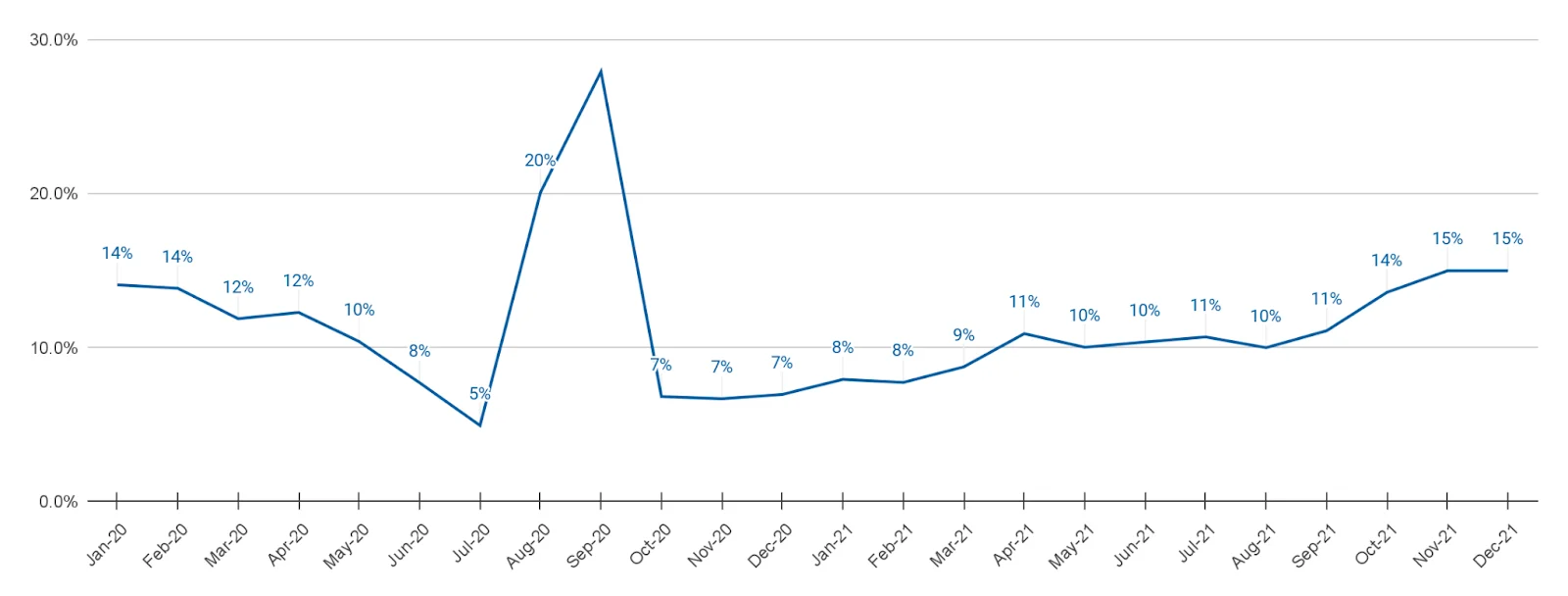

The performance of QuickCheck’s loan book has been proven over several years. NPL (non performing loans) has remained at a very low level and its AI-based underwriting model ensures that the capital recovery rate remains high.

Since its inception, the company has issued loans worth over $50M, approving 1.7M loans out of 5.1M applications.

To start the cooperation, QuickCheck will offer loans with yields payable of up to 15% p.a. All the listed loans will be covered with a 60 day buyback guarantee.

QuickCheck’s detailed presentation and the company’s financials can be found in the Loan Originator section.

Log in to your account to diversify your portfolio with QuickCheck.