Meet Dineo!

We are delighted to introduce you to our newest partner loan originator Dineo.

Dineo was born in Spain in 2014 as a Social Limited Company. Allocated in Cash Converters stores, Dineo provides offline financial solutions for non-digital users through 75 selling points across Spain. They also cover the digital market needs through its online platform, allowing users to request, extend or pay back their loans.

Dineo finances consumer loans to individuals from 50 to 600 euros, with interest rates at Lendermarket from 10% to 15% for their short-term loans up to 90 days. They offer a buyback guarantee after 60 overdue days, which is also covered by a group buyback guarantee. The maximum extensions for their loans will be of 30 days up to two times.

Since its inception, Dineo has helped more than 195,000 clients and has issued more than 1,4 million loans valued at 335 million EUR.

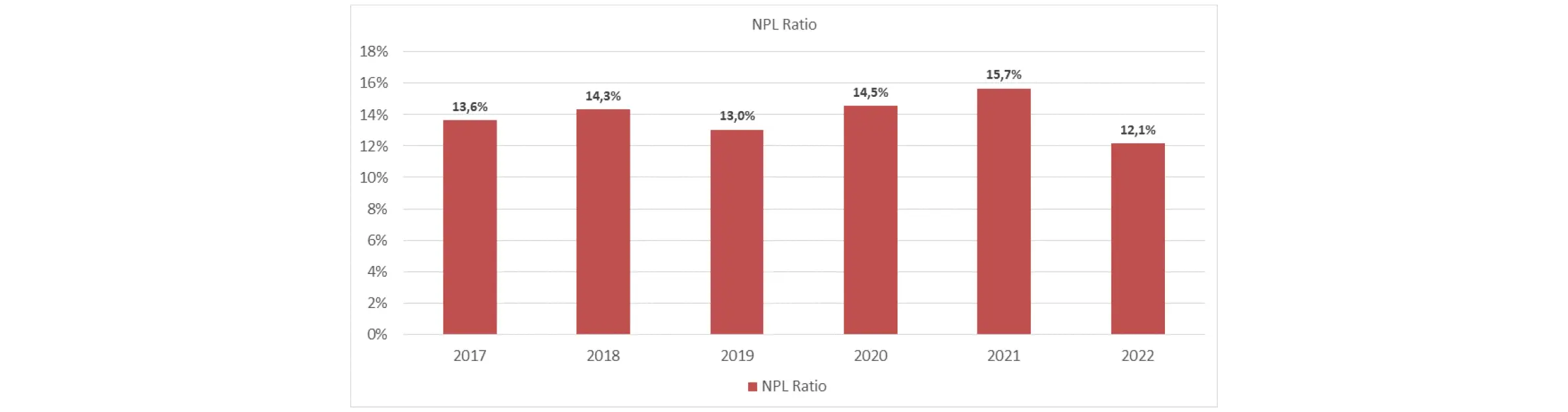

They finished 2022 with an income of €15.9M, and its default ratio stayed under 11% while its NPL ratio was at 12.1% decreasing 3.6 percentage points from the previous year.

What is their offer at Lendermarket?

![]() Annual interest rate 10% – 15%

Annual interest rate 10% – 15%

![]() Buyback guarantee – Yes!

Buyback guarantee – Yes!

![]() Group guarantee – Yes!

Group guarantee – Yes!

![]() Average loan term up to 90 days

Average loan term up to 90 days

![]() Skin in the game 5% to 10%

Skin in the game 5% to 10%

Dineo’s detailed presentation and the company’s financials can be found in the Loan Originators section. Log in to your account to diversify your portfolio with new loans from Spain.