Total Loan Volume Originated shows the amount in euros that the loan originators made available to invest on Lendermarket. The graph below shows the cumulative loan volume originated in the last 6 months on the platform.

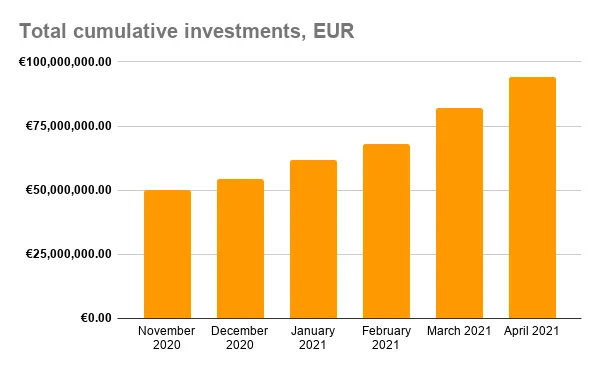

The graph above shows the cumulative investments placed at Lendermarket in the last 6 months. In other words, the total amount in euros that investors have invested in loans since Lendermarket started operations.

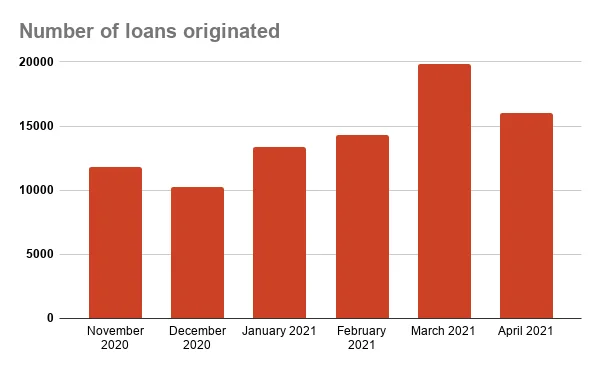

In this graph it can be seen how many loans the loan originators have listed at Lendermarket and made available for investment every month.

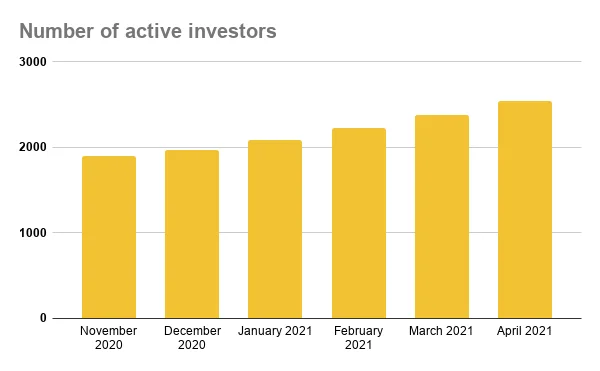

Active investors equal users that currently have funds in their investment accounts. The number of active investors has been growing steadily month by month.

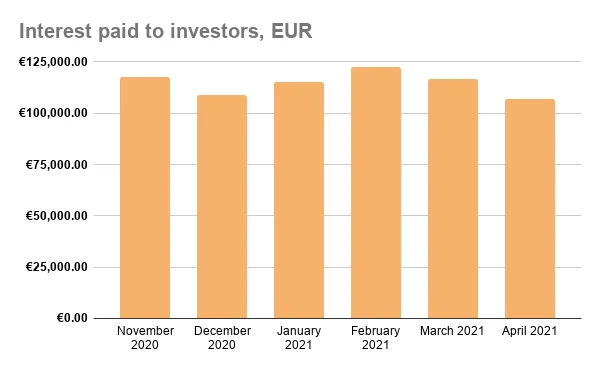

Here we can see the amount of interest income earned by investors in each month. The graph includes regular interest and delayed interest – interest received by investors when the loan is overdue.

Key Takeaways

We have helped our investors earn a €107,014 of return in April. We added 16,002 new loans to the platform last month, thus, the total number of loans grew to 202,648. Cumulative volume totaled to €94,013,294M. This means that our investors funded over €11M worth of loans last month, which is 3700 % more than the same time in April 2020.