A lot of advice for investing always focuses on the goal of investing for your retirement, which usually indicates a very long timespan of 20 or more years. But investing can be so much more and also be applied for short-term goals with a timeline of 3 – 5 years.

Whether you’re saving for a house, a new car, or even your dream vacation, investing might be able to help you achieve that goal faster. In this article, we’ll cover the benefits of investing for short-term goals, what you should look out for, and what assets are most suitable for this.

Benefits of investing to meet your short-term goals

There are numerous benefits to investing to facilitate meeting your short-term goal, such as not letting the money depreciate while it’s sitting in the bank. In the following section, we want to touch on 3 major upsides investing offers.

It keeps you from buying something else

“Out of sight, out of mind”, this principle also holds true with money, and it’s why many finance experts recommend keeping your emergency fund in a separate account – so you don’t spend it. If you invest the money, you go even one step further, as it’s not just out of sight but also out of reach.

Being disciplined with money is unfortunately not something we get taught in school, so we have to build up discipline as adults. To help you make good decisions and not spend the money you worked so hard for on things you don’t need, it can make sense to invest it.

That way, you’re unable to access it for a period of time and can be sure it’ll be there for when you want to make the big purchase you’ve been saving up for.

Beating inflation

Inflation means losing purchasing power, which basically means that, for example, 1 EUR can at current times buy you a kilogram of apples, but in 10 years you can only buy 500g of apples for it.

There are many ways to protect against inflation, and investing is usually the one thing that intertwines all these ways, as returns are needed to outweigh inflation.

Just imagine this: With a yearly inflation of 5%, your money would be worth 22.6% less after only 5 years!

If you would rather not run the risk of your money depreciating year over year, it’s perhaps time to consider investing it – if even for the short term.

Gives a chance to reach goals faster

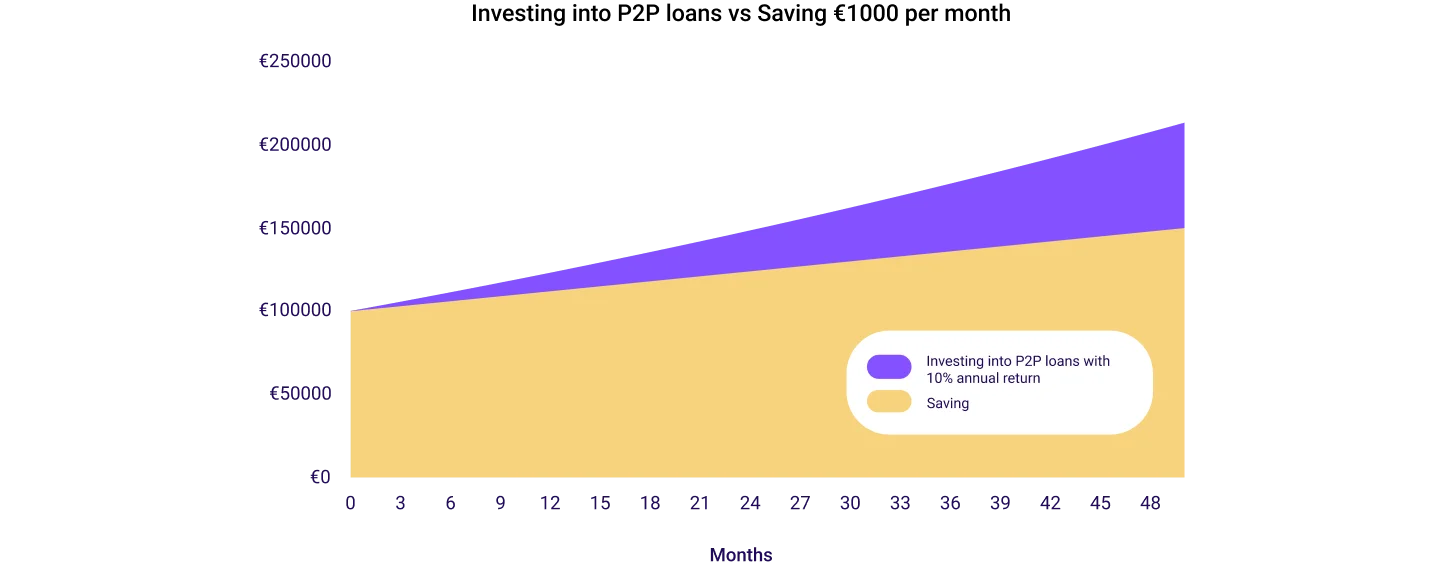

Another reason it could make sense to put your money to work for you is because it’ll grow and give you a chance to reach your goal faster. Let’s assume the following things:

- The amount you need for your goal is 150,000 EUR

- You already have 100,000 EUR saved up

- You can save 1000 EUR every month

If you were just saving, then you would reach that goal in another 50 months, or a bit over 4 years.

What would it look like if you invested your money into P2P loans with 10% interest? Then you would reach your goal after 25 months, so merely half the time.

Short-term investing rules

Of course there are some things that you should keep in mind when investing your money for the short term. We’ll highlight 3 essential rules.

Low-risk is not “no-risk”

When you’re investing your money you should know about the risk of the assets you invest in. Investing is not gambling, and especially if you have a specific goal you want to reach, it would hurt even more if you lost a lot of your money.

In general, when investing your money for the short-term, you’ll tend to pick assets with relatively high liquidity and less long due dates, so no time deposits with a 10-year timeframe.

Nevertheless, even short-term investments carry some risks. So, perhaps take our fun quiz to find out our risk tolerance and read about 5 ideas for a low-risk investment.

What are the best assets for short-term investing?

In general, you can favor less risky assets with more stable returns over assets like stocks, which can in the long run outperform many assets, but in the short term just as well make -20%. And if it’s down when you wanted to reach your goal, and you’re forced to sell – that’s bad.

Some assets that are good for short-term investing are:

- Time deposits

- Bonds (preferably AAA bonds)

- Cash

Should you invest all your savings?

Again, this comes down to your risk tolerance. But for one, you should always keep some money as an emergency fund (say 3 – 6 months of expenses), and it might give you more emotional well-being, if you know you have cash sitting in the bank that you won’t lose.

Short-term investing in loans

P2P loans can be a suitable option to invest in the short term for the following reasons:

- You can invest as little as 10 EUR

- Loan originators on Lendermarket offer a BuyBack Guarantee, where they’ll pay back the principal + outstanding interest if the loan enters “default” status

- Due dates for loans range from 1 – 36+ months, so you can pick short-term loans allowing you to access your money quickly

- With the Auto Invest feature, you can define investment parameters, and let the computer invest for you

- P2P lending is a fixed income investing. Therefore you know how much you will earn from each investment.

Conclusion

Now you know that investing can even make sense if you’re saving for a short-term goal. Not only does it keep you from spending that money, but you might even be able to reach your goal faster.

Just keep in mind to assess the risk of the asset you’re investing in, and always keep some cash in reserve for unexpected expenses. If you want to avoid having your money bound to an asset for too long, you can also prefer short-term investments, such as P2P loans.