We are delighted to announce the upgrading of our Lendermarket investor dashboard and increased transparency of how your funds flow to and from loan originators. Specifically, we will be displaying in your dashboard where your funds are pending receipt of payments from a loan originator. With the “Pending Payment” status, you will be able to track the progress of your earned interest and principal repayments through different stages of the Funds Transfer Flow.

Additional Status to Provide Transparency to Investors

To better understand the flow of your funds (earned interest and principal repayments) yet to be credited to your account you can now find “Pending Payments” status in your dashboard . When a Loan Originator notifies Lendermarket of a borrower’s repayment a “Pending Payment” status is assigned. At this point, we have only received notice of the upcoming transfer. We are still waiting for the Loan Originator to complete the transfer of funds to Lendermarket. Once the funds arrive, your account will be promptly credited thereby reducing your Pending Payments and increasing the Available Balance.

Funds Transfer Flow Stages Explained

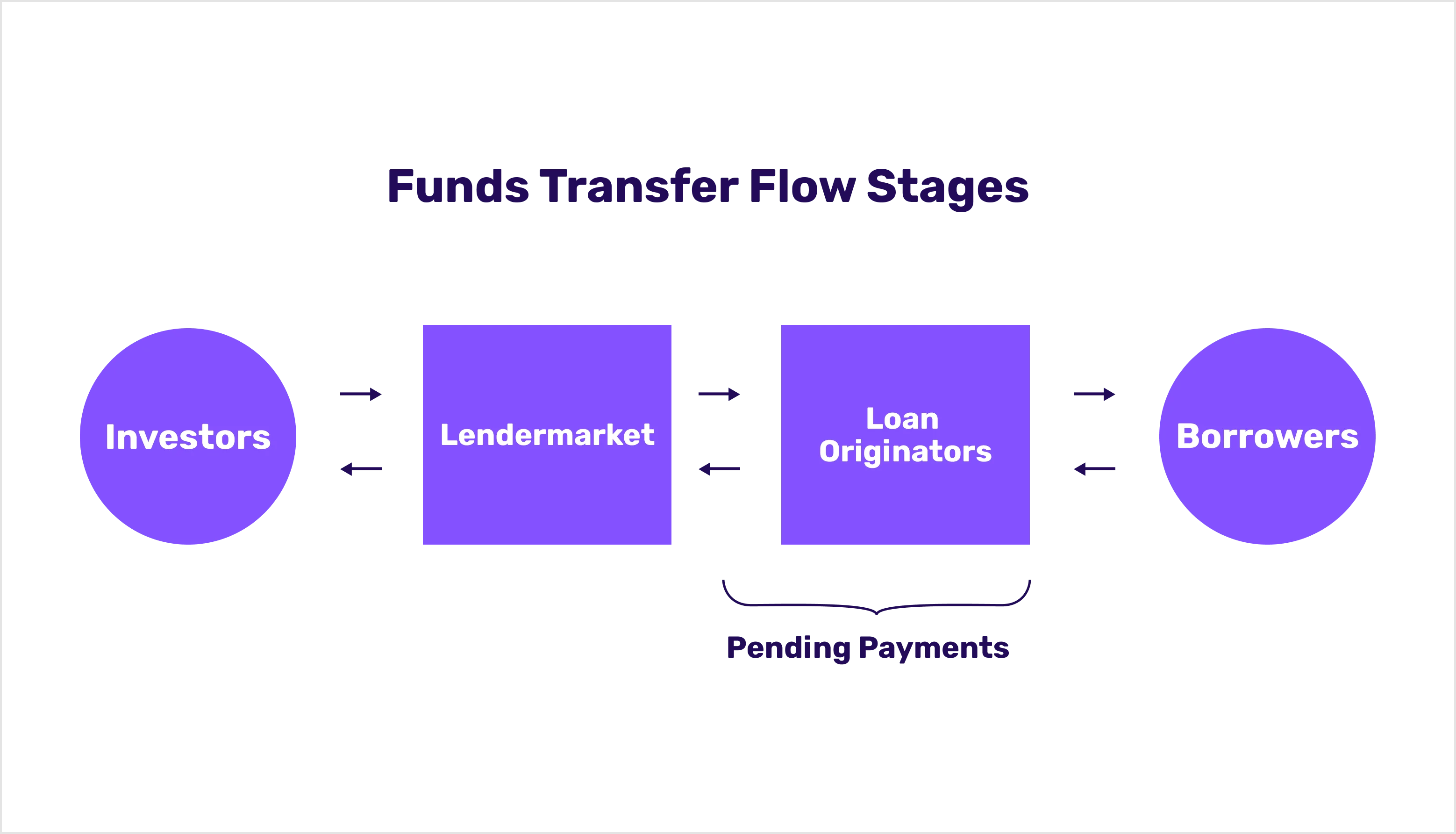

As an investor on Lendermarket’s platform, you earn interest and receive principal repayments by investing in loans by Loan Originators. In this process, multiple parties are involved in the funds transfer flow. When a borrower makes a repayment, funds are first transferred to the Loan Originator, then to Lendermarket and then finally distributed to investors. The transfer of funds from Loan Originators to investors takes time. To reflect the flow stages clearly, we have implemented the “Pending Payment” status for payments on Lendermarket’s platform.

Pending Payments are released to your Available Balance as soon as Lendermarket receives the funds from the Loan Originator. The release time of Pending Payments depends on the terms of the Loan Originator and Financial Institutions and market conditions. It is typical to observe an increase in Pending Payments during times of decreased demand caused by events such as the COVID-19 pandemic, the war in Ukraine, sanctions on Russia or during economic downturns.

Understanding Account Information

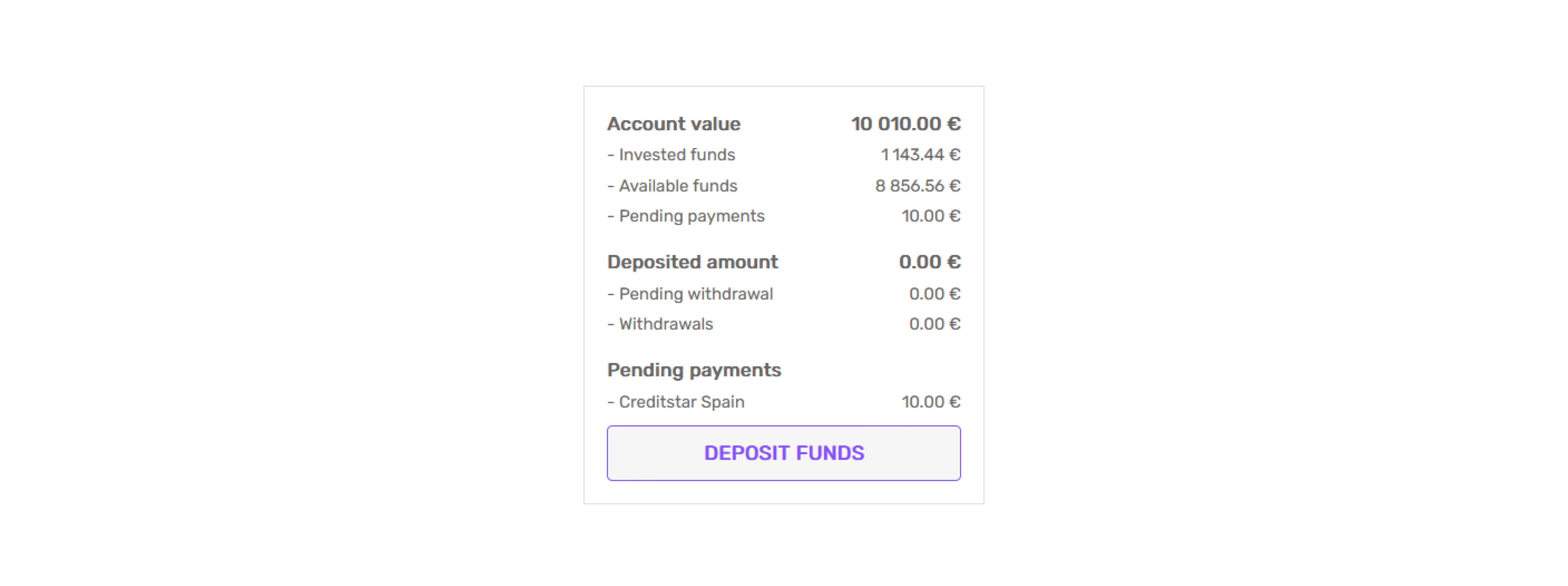

Your overall Account value includes Pending Payments and the Available Balance. To provide you with greater clarity we have also separated these amounts as per the below:

The Available Balance represents the total amount available to reinvest or withdraw.

Pending Payments represent your earned interest and principal repayments that are not immediately available.

How is interest on an investor’s Pending Payment balance calculated?

If in the event that an investor has a pending payment balance from a loan originator, the loan originator has 10 days to make the pending payment. During this 10 day period, no interest will accumulate. However, after 10 days, the investor’s Pending Payments balance will start to accumulate interest at a rate of 18% per annum.

Interest on an investor’s Pending Payment balance starts to be calculated after the 10th day, and it’s calculated using a simple formula:

Outstanding Amount x Pending Days x Daily Interest Rate of 18%.

Example:

Outstanding Amount: €100

Pending Days: 30

Interest (per annum) = 100 x (30-10[Grace Period]) x (0.18 / 360) = 1€.

Interest on an investor’s outstanding Pending Payment balance is transferred to the investor’s Available Balance after the Loan Originator’s settlement payment is received.

Can I reinvest my Pending Payments?

Yes. You will be able to reinvest your Pending Payments even before they are released to your Available Balance.

We hope that the introduction of the “Pending Payments” feature will enhance your experience on our platform and provide you with greater transparency into the status of your funds. Should you have any questions or require further assistance, please do not hesitate to reach out to our Investor Support team via [email protected].