Let Lendermarket Pay for Your Christmas

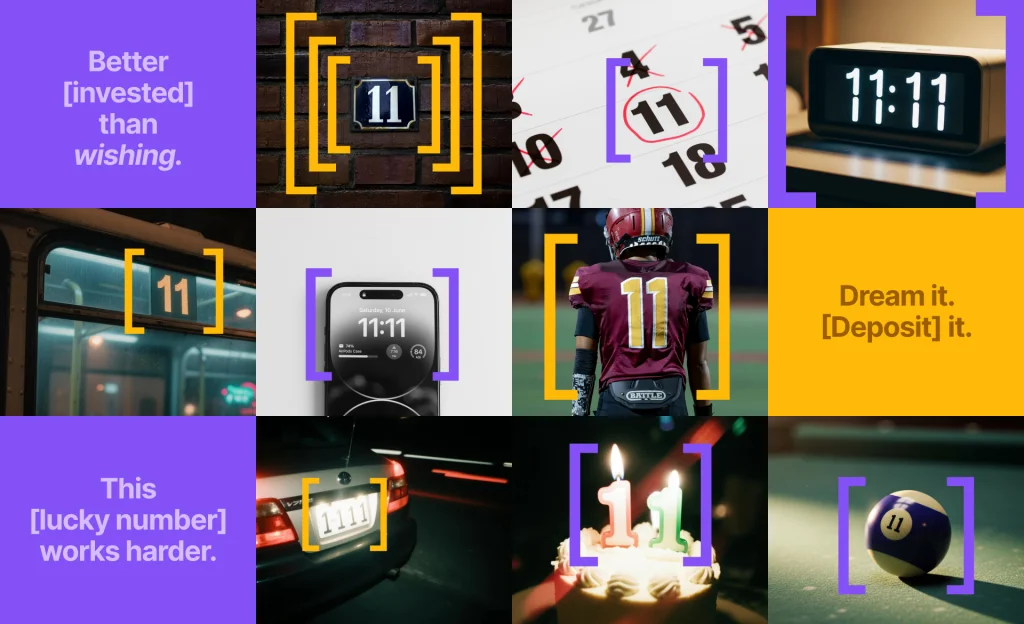

This December, you can boost your holiday season with a cashback bonus of up to 3% when you invest newly deposited funds through campaign-exclusive Auto Invest portfolios. Time left to earn the last cashback bonus of