Lendermarket in 2024: A Year of Growth and Achievements

2024 was truly a standout year for Lendermarket and its investor community, marking a significant chapter in our five-year journey. Together, we celebrated remarkable

Lendermarket is tailored to meet the needs of investors across Europe. Switch the language in the top navigation bar to access localised insights, resources, and updates for your region. Investing made easy—wherever you are!

2024 was truly a standout year for Lendermarket and its investor community, marking a significant chapter in our five-year journey. Together, we celebrated remarkable

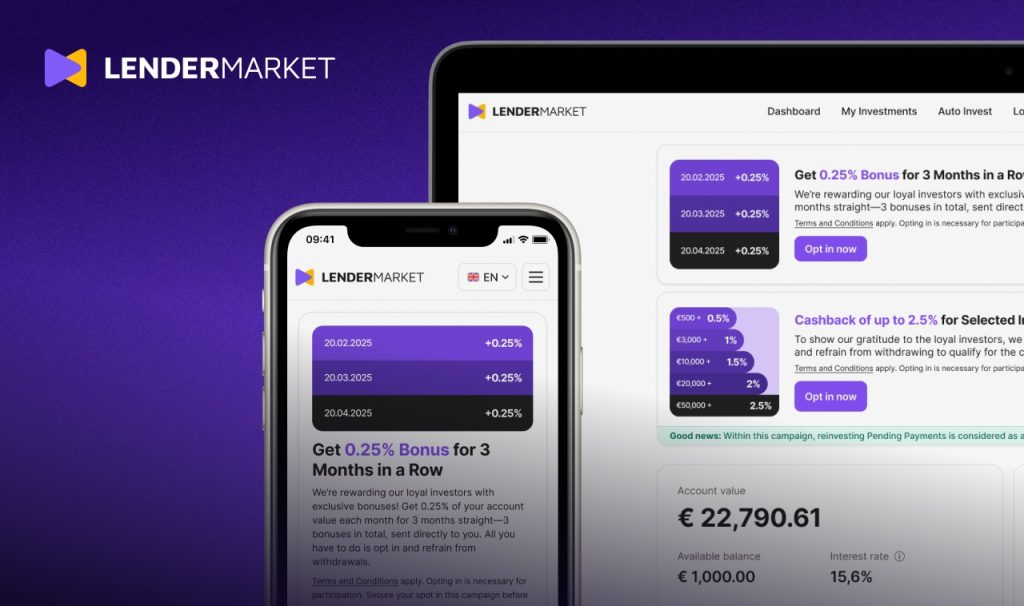

Exclusive Bonuses Paid Out—Here’s How Lendermarket Investors Earn More Smart investing isn’t just about choosing where to put your money—it’s about seizing opportunities to

How do P2P platforms and Loan Originators make money? P2P lending is a relatively new way of investing, which offers high return rates of

Valentine’s Offer: Investing is Better with a Plus One! Investing with friends isn’t just more enjoyable—it’s more rewarding too! Plus, with our limited-time Valentine’s

Lendermarket is Expanding: Poland, You’re Next We’ve got exciting news to share with you – Lendermarket is launching a fully localised Polish website. For

Exclusive January Offers for the Lendermarket Community 2024 has been an exciting year for Lendermarket and our amazing community. To celebrate, we’re rolling out

A Conversation with Erik, Lendermarket Investor Welcome to our “Lendermarket Stars” blog series! Here, we share inspiring conversations with real investors, passionate members of

Lendermarket Secures Authorisation to Operate as a Crowdfunding Service Provider in the EU Lendermarket has achieved a significant milestone in December by securing authorisation

Wrap Up 2024 Strong with Exclusive Rewards As the year comes to a close, there’s no better time to celebrate your investing success and

Last Day: Limited Time Offers—Instant Bonus & Referral Boost!