When reading about investing, it’s easy to get carried away with all the advice on: “Buy now, prices are good”, and “prices are dropping crazy fast, better to sell!”. Furthermore, there’s lots of advice on quickly flipping your investments to make money. Also called day trading.

Studies have shown, however, that 97% of all day traders lose money and only a mere 1% are profitable. That’s why in this article you’ll learn everything about long-term investing benefits, a way more relaxed way to reach your goal. With a higher success rate too!

What is long-term investing?

Long-term investing is an investment approach where you keep your money invested for a long period of time. How long differs, and there’s no definite answer on that. Here are some durations that are usually considered long-term, for a variety of asset classes:

- Stocks: 10 years or longer

- Real Estate: 5 years or longer

- Bonds: 10 years or longer

- P2P investment: 3 years or longer

The essence of this method is that you invest your money once, and then hold it for a long period of time. This brings a couple of benefits with it, which we’ll touch upon in a bit.

The opposite of long-term investing is buying any assets, be it stocks, real estate, bonds, or even investing in P2P loans, with the intention to sell it soon thereafter for a profit. It’s especially common in the stock market.

People think they can predict the markets, buy their shares at the bottom and sell at the top. The reality is, however, that no one can predict where markets go. Not with stocks, nor with real estate or others.

Investing with a long-term investment horizon is therefore considered by many experts to be a more sensible, and especially hands-off approach.

Long-term investing benefits

There are a couple of benefits when you decide to invest your money long-term. Things such as allowing your money to accumulate and using the resulting interest to compound onto itself to reach higher returns. It’s also less strenuous on your emotional wellbeing.

1. Compound interest

There is a quote often attributed to Albert Einstein: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

The human brain is made to understand linear growth, i.e., if something grows steadily at 10 percent per year or by 200 units every month. With compound interest, you get exponential growth, however. This means the 10% yearly will compound onto itself to grow more, and more, and more.

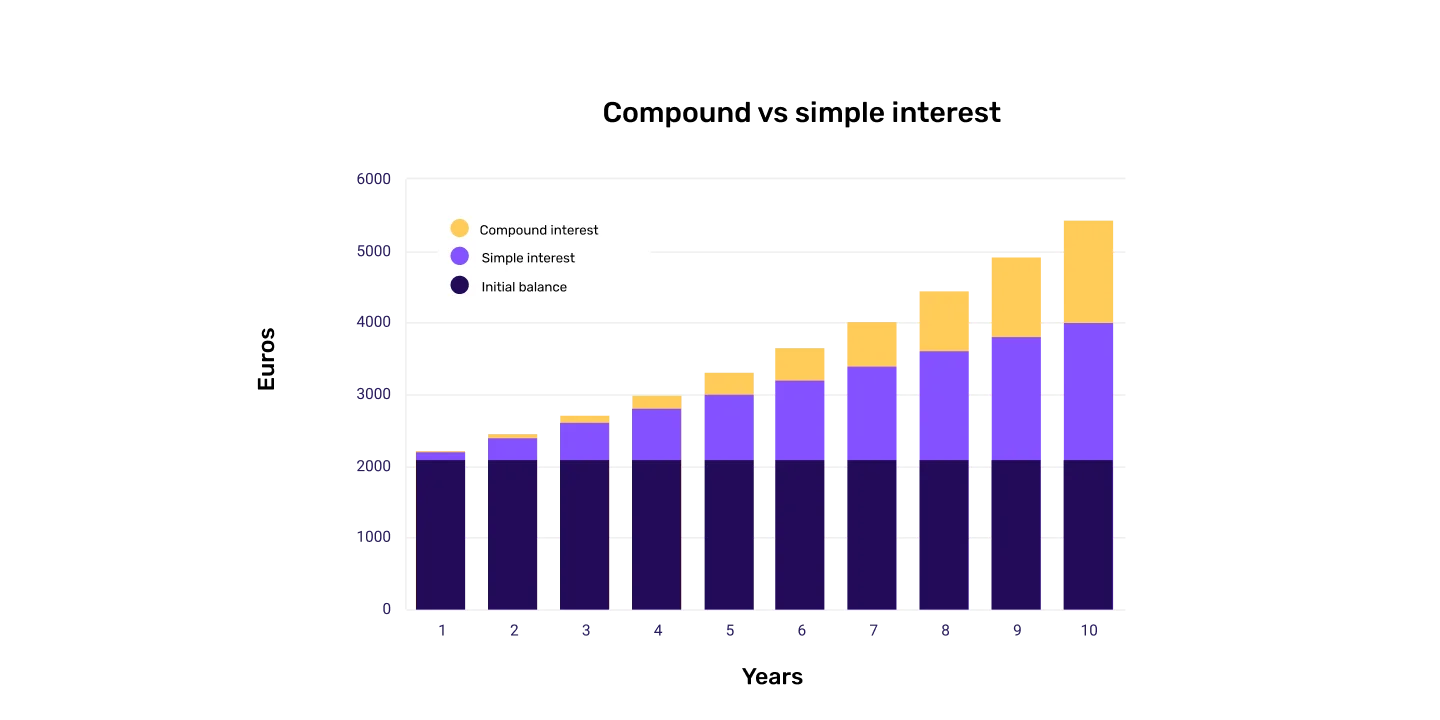

Take a guess: If you have 2000 EUR and invest it at 10% per year, taking out the returns every year, how much will you end up with after 10 years?

And now the same calculation, but leaving in the interest received to let it accumulate. What will the result be after 10 years.

The result?

- Simple interest: 2000 EUR in interest after 10 years, total up to 4000 EUR

- Compound interest: 3187 EUR in interest after 10 years, total up to 5187 EUR

That’s a difference of over 25% and the results get more breathtaking the longer you stay invested for.

Learn: Staying invested long-term allows you to reap the benefits of compound interest.

2. Higher interest rates

Another long-term investing benefit is that investments with longer durations can offer higher interest rates. You see this with bonds, where long-term bonds provide you with a higher coupon rate because it gives the emitter more security, as they in turn, can plan long term with your money.

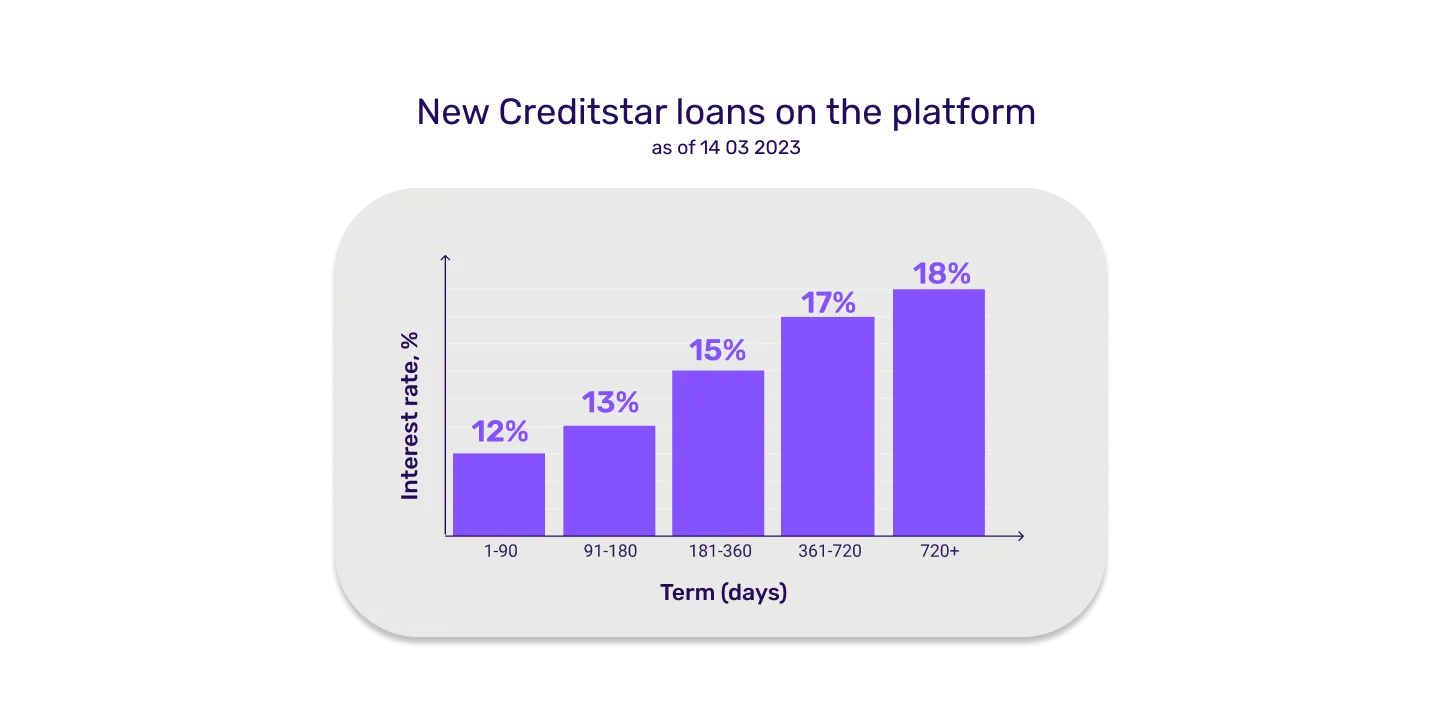

The same also holds true with the new Creditstar loans on Lendermarket. Loans with a duration of 90 days or longer provide better interest. If you up that duration to 181 days or beyond, it gets even more favorable.

Not all asset classes provide higher interest rates for longer holding periods. Stocks or real estate are not included in that equation. But if you’re looking to invest in bonds or P2P loans, the increased interest is another plus.

Learn: Some asset classes such as bonds and P2P loans offer higher interest rates for longer investment terms.

3. Long-term investing saves time

Imagine you would invest your money into something and constantly have to monitor its performance. Buy some, sell some, stay on top of the newest developments in the market? Let’s be real here, nobody with a job has time for that nowadays.

If you instead put your money to work for you, maybe invest regularly, but stick to what has proven to provide good results you’ll have more time, and likely be more successful.

Learn: Sticking to your investments instead of constantly buying and selling saves time.

4. Less risky

A common pitfall investors make is thinking they can time the market. As stated earlier, no one knows if markets will rise or fall. If you try anyway, chances are high you’ll buy let’s stay stock, wait for it to go up, but instead the price keeps on sinking. Or the other way around: You sell, thinking prices will continue to plummet, but instead they rise.

Staying invested long-term, you won’t act, whether the prices are high or low. The S&P 500, for example, achieved an average of 6.6% annual returns since 1900 – but there were ups and downs. You just need to sit through them.

Learn: Investing long-term with a diversified portfolio is historically less risky then trying to pick the best performing assets.

5. Less emotional

Lastly, staying invested long-term puts less strain on your emotional wellbeing. Seeing the value of your investments drop, perhaps for a long time, can bear heavy on your mind. Just as much as the joy when prices recover and soar to new heights.

Don’t get carried away thinking you need to sell or buy now. If you don’t give yourself the option to buy or sell, these changes in prices won’t affect you as much. After all, it’s only a loss if you decide to sell at a loss.

Learn: Long-term investing takes less toll on your emotional well-being.