Think Forward: A Smarter Way to Start Your 2026 Portfolio Growth

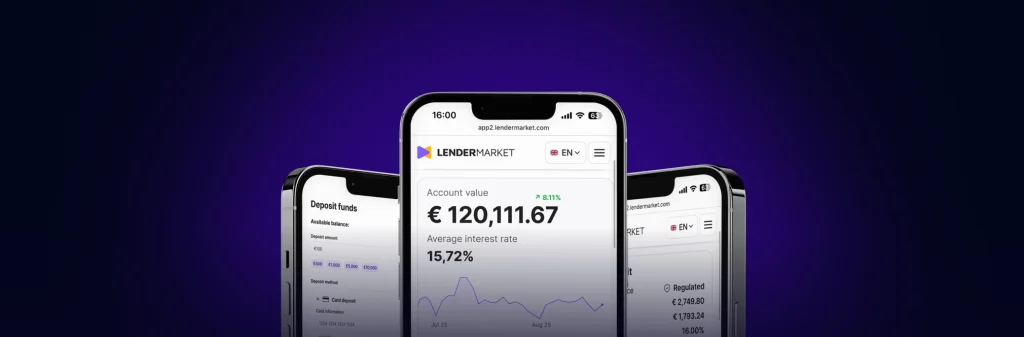

Promotional Campaign Think Forward: A Smarter Way to Start Your 2026 Portfolio Growth The start of a new year is the perfect time to take clear steps toward your financial goals. We believe that success is