We are glad to announce that we have launched a new statistics page which will provide more comprehensive information about Lendermarket platform performance. We hope a new feature will bring more valuable information to our investors.

We want to inform you that this blog post is the last of the “monthly stats” series, as our new statistics page is always reachable through the website footer menu under the “About Us” section.

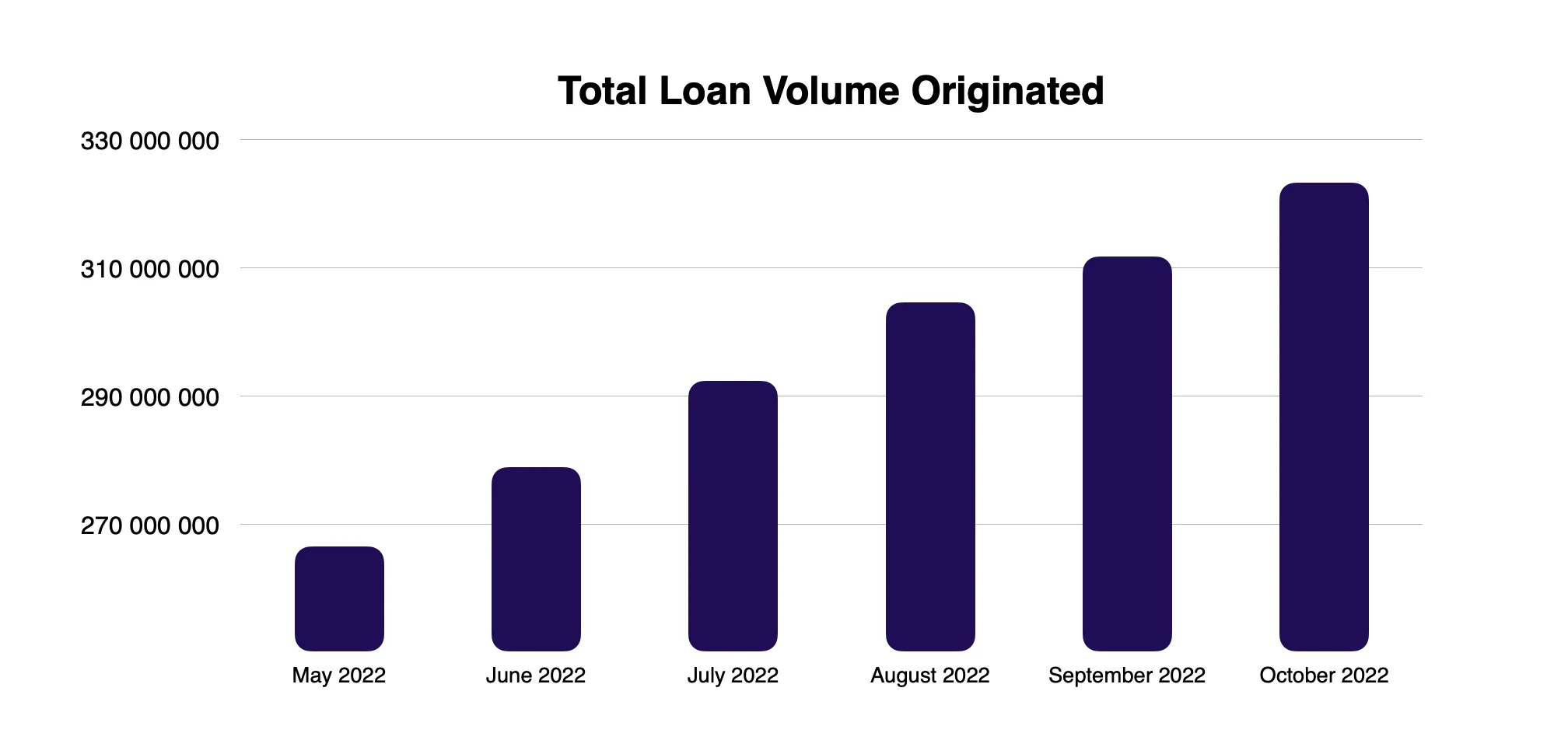

Total Loan Volume Originated shows the amount in euros that the loan originators made available to invest on Lendermarket. The graph below shows the cumulative loan volume originated in the last 6 months on the platform.

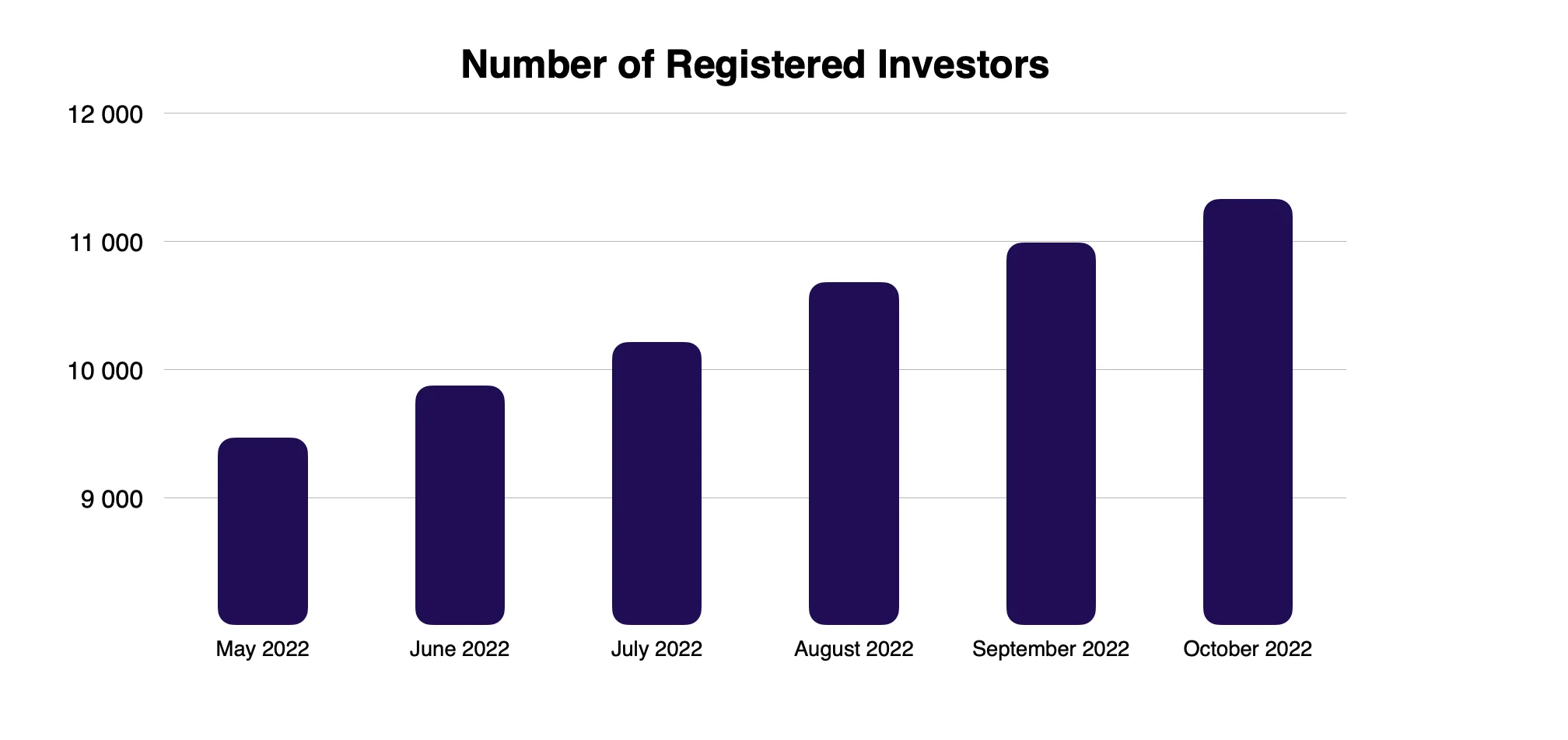

Number of investors equal users that currently have funds in their investment accounts. The number of investors has been growing steadily month by month.

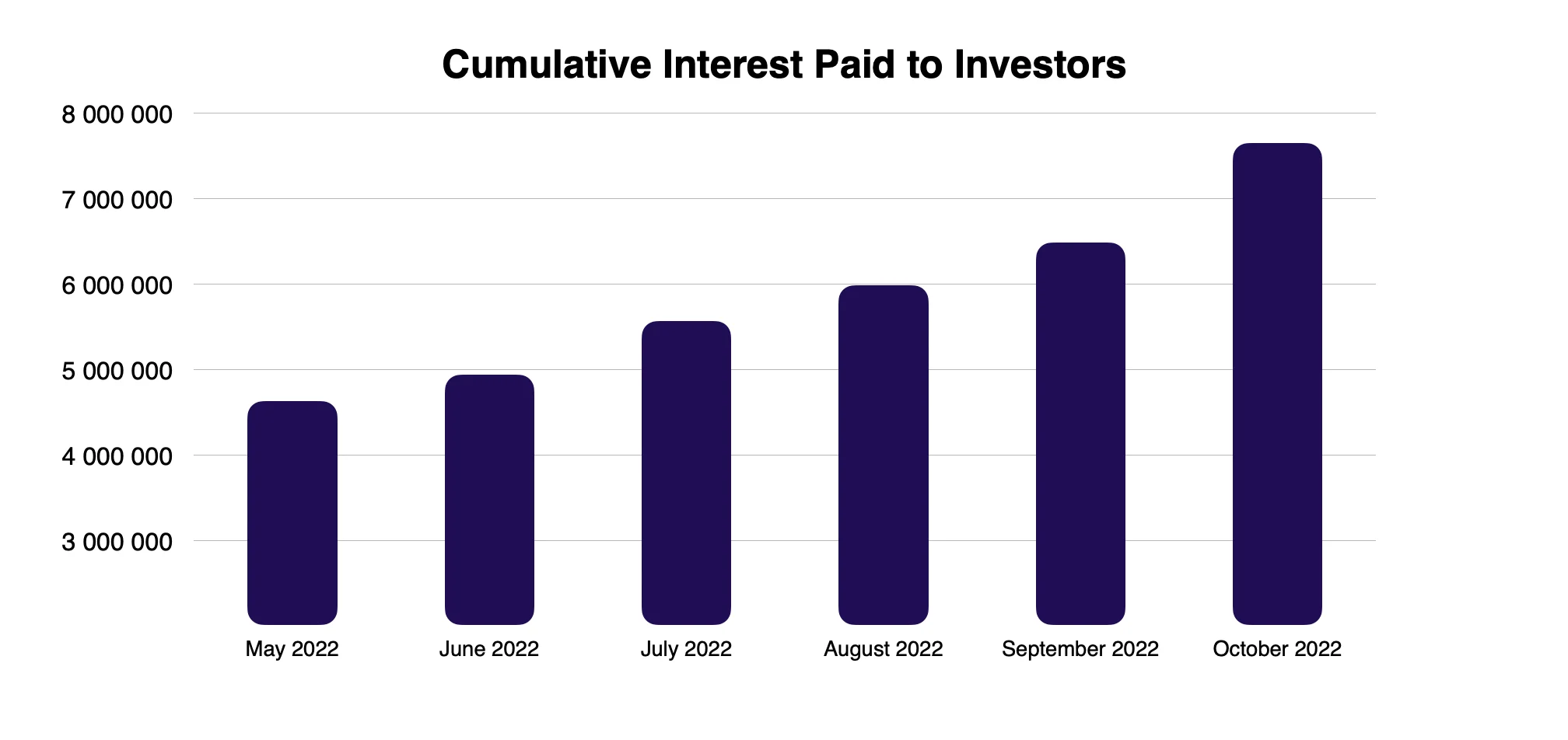

In the graph below we can see the amount of interest income earned by investors since Lendermarket started operations. The graph includes regular interest and delayed interest – interest received by investors when the loan is overdue.

Key Takeaways

We have helped our investors earn €1055799 in returns in October. We added 26 739 new loans to the platform last month, and the average nominal interest rate last month was 14.33%.