The Auto Invest feature of Lendermarket is a handy tool to save you time and allow for more flexibility when investing your money. In the first part of this two-part series, we’ll dive deeper into how to set up your Auto Invest portfolio initially to cover all you need from it.

In the second part, we’ll highlight how you can make the most out of it. Let’s go!

What is Auto Invest?

When you invest into P2P loans, you can often start investing with as little as 10 EUR per loan. To increase your diversification, it can be a good approach, to invest 10 EUR per loan and spread your investment over a high number of loans.

However, doing so by hand can eat up a big chunk of your time. Imagine you want to invest 5000 EUR at 10 EUR per loan, that would be 500 individual loans. You can likely imagine that that’s not done within a few minutes. Furthermore, you would have to sort them all by interest rates to find the range you wish to invest in, specify the loan terms and more.

Our Auto Invest feature takes all that hard work off you. It’s like a robot, that you tell the specifics how to invest once, and it then looks for all matching loans and distributes your funds accordingly.

This not only allows you to save time but also build a variety of portfolios with different interest rates, loan originators and more, thus giving you the opportunity to try out multiple investment strategies to find the one most optimal for you.

The main features of Auto Invest

When setting up your Auto Invest, there are a couple of features that you can adjust. In this article, we’ll cover:

- Portfolio name

- Min and max investment amounts

- Option to include loans you already invested in

- Choice of loan originators

Let’s shed a light on each of these to see what they do and how they can help you achieve your goals.

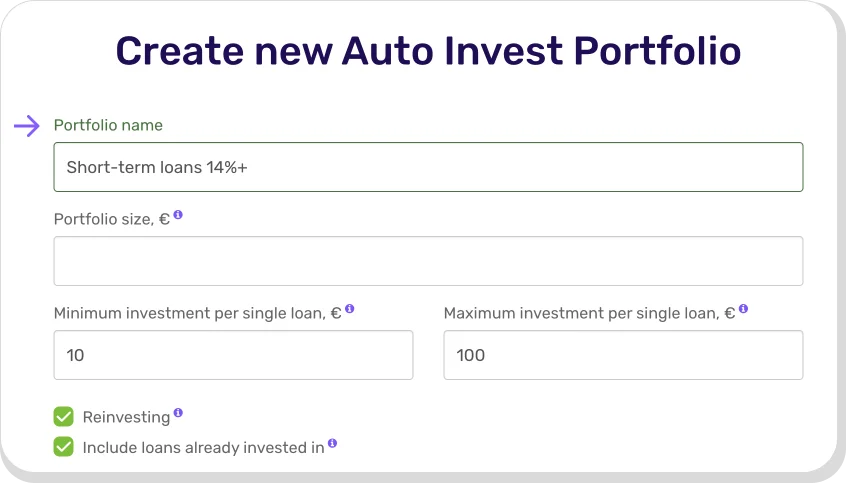

Portfolio name

When creating a new AI portfolio, you can choose to give it a specific name. The standard is “Portfolio X” where X is the number of your portfolio, i.e. Portfolio 1, Portfolio 2, Portfolio 3. This can make it hard to distinguish between each of them, which is especially cumbersome if they have different investment criteria.

One way to use the naming feature to your advantage is by using keywords in the name to specify what it is about. So for example, if you create an AI portfolio that will only contain short-term loans with high-interest rates, you could pick the portfolio name “Short-term loans 14%+”.

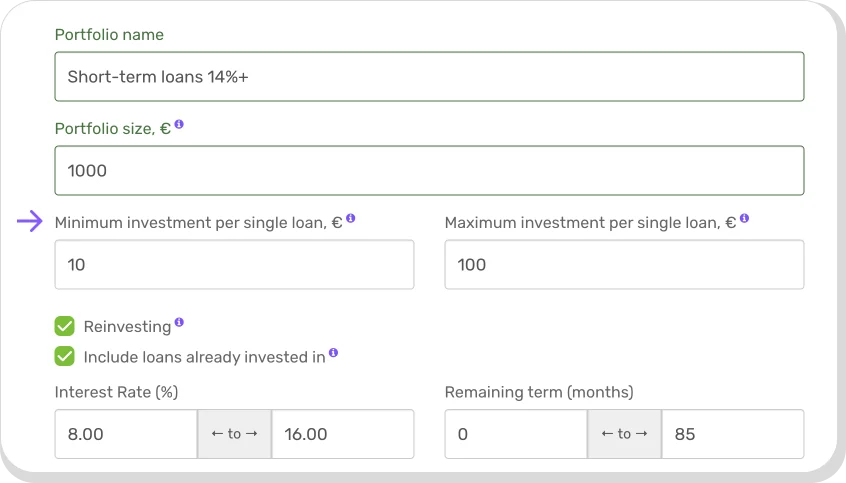

Min and max investment amounts

On Lendermarket, the minimum amount you can invest into loans is 10 EUR. So, when you define your minimum investment per single loan, you can’t go under that threshold. On the other hand, there is no maximum investment per single loan, so you can theoretically pick a number as high as you want.

What each of these numbers mean:

- Minimum investment amount

You define the minimum amount that can be invested into an available loan. If you pick 10 EUR, then the AI will invest into loans where a minimum of 10 EUR investment volume is available. In case you decide on 20 EUR, then that will be the minimum and loans where <20 EUR loan volume is available won’t be invested in. - Maximum investment amount

That’s the maximum investment amount the AI will put into a single loan. Say you put it at 100 EUR and keep the minimum amount at 10 EUR, then the AI will invest between 10 – 100 EUR per loan. If you increase that amount to 5000 EUR, but only have 1000 EUR available in your account, then the AI could invest 1000 EUR in a single loan. Keep in mind, though, that this greatly affects your diversification.

In essence, you could say: The smaller the minimum and maximum amounts are, the higher is your diversification. Yet not always will you find enough loans that fit your other criteria like loan length or interest rate, so it can make sense to adjust the max investment amount.

Option to include loans you already invested in

Under the min and max amounts, you will find two checkboxes, whereof one is titled “Include loans already invested in”. This feature is by default preselected. It enables you to manually or automatically invest into loans you have already invested in.

If you keep this option selected, it will also affect your diversification because instead of picking only “new” loans, the AI will also consider already invested in loans.

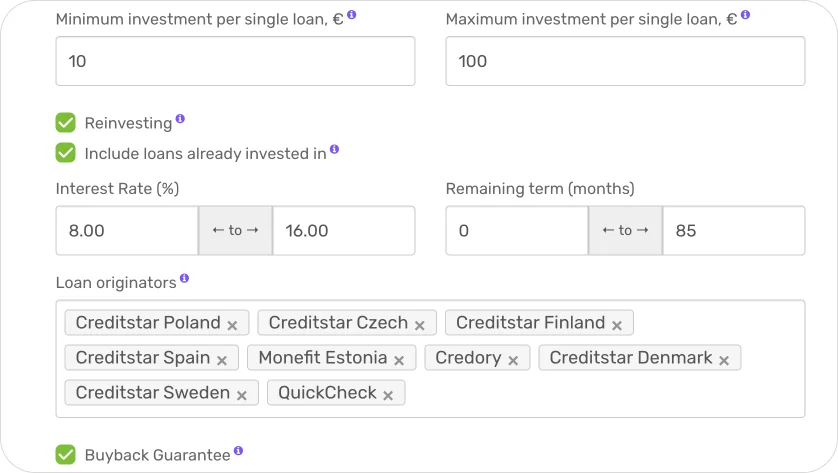

Choice of loan originators

There are multiple different loan originators (LO) on Lendermarket, some operating in multiple countries. Under the “Loan originators” section, you can decide which loan originators’ loans should be made available to the AI in this portfolio.

Different LOs have different business models, and you could be more inclined towards one than another. For example, Creditstar issues private consumer loans, whereas Credory focuses on real estate-backed business loans. Furthermore, Creditstar operates different companies in each of their lending countries, so you can specify even more.

If you don’t want to make any changes here to harvest the highest amount of available loans, then that’s also fine, and no work is needed from you in this section.

Conclusion

If you build your portfolio, it can be fun picking your first few loans manually. You get to know how the platform works, can read in-depth about different loan originators, loan terms etc. Once your portfolio grows to a certain size, though, it can be tedious picking every loan by yourself, especially if you want to maximize diversification and invest the minimum amount of 10 EUR in each loan.

That’s where the Lendermarket Auto Invest feature comes in handy. It follows the formula of “set it and forget it”, where you define the criteria once and then let it run. You can even create multiple AI portfolios to find out what strategy works best for you. Give it a try, you can start with as little as 10 EUR.